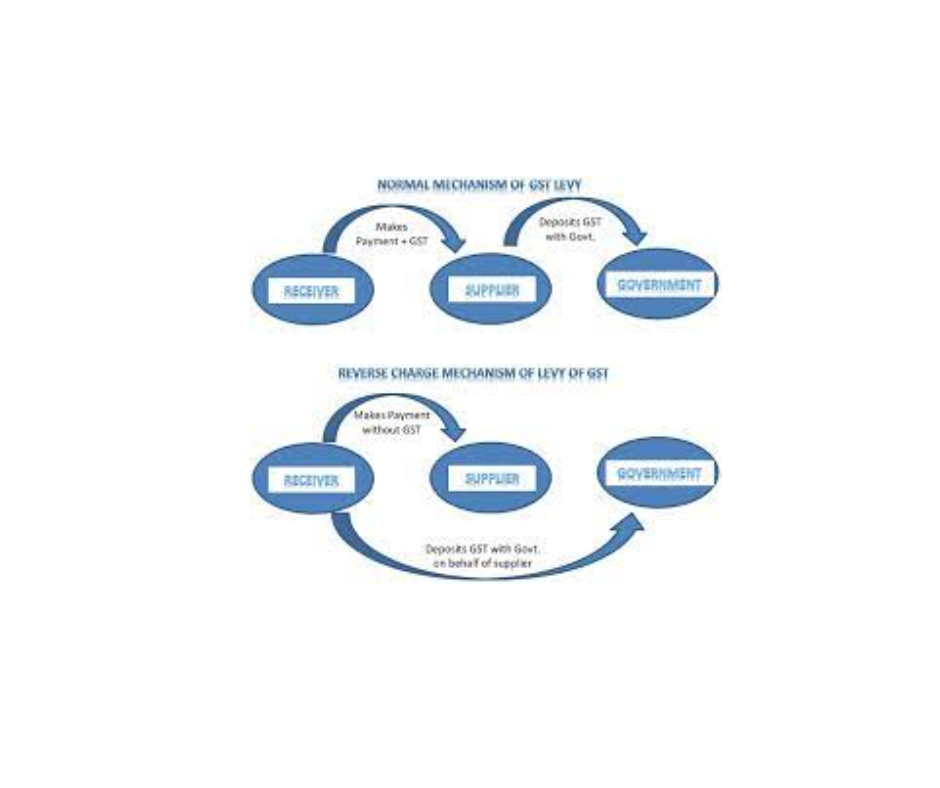

Who is tax collector in gst?

GST tax collection authority GST tax collection authority, In the realm of Goods and Services Tax (GST) in India, a tax collector denotes an individual or entity entrusted with the task of gathering and remitting GST payments to the government for the purpose of GST tax collection authority. The following entities are typically… Read More »