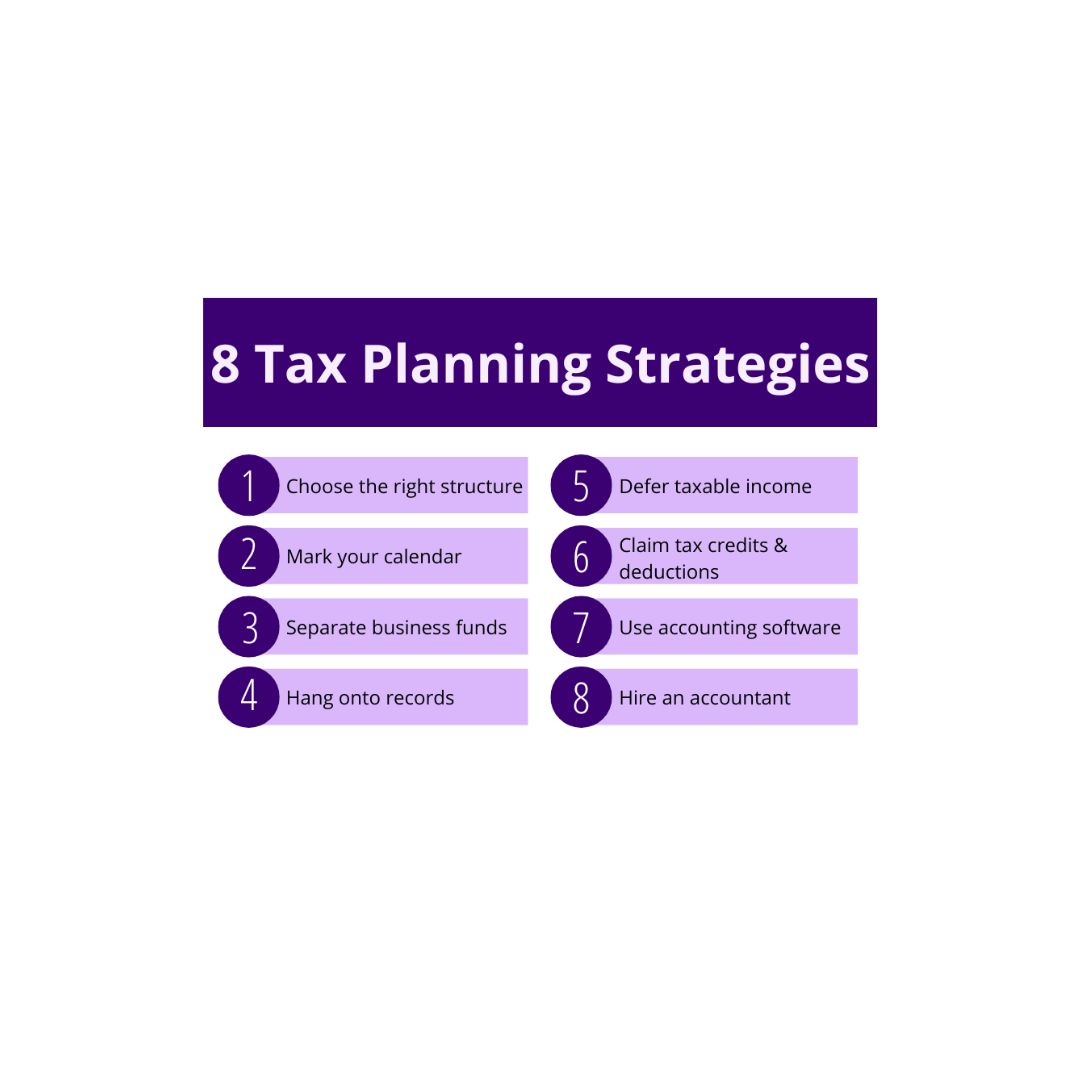

What are tax planning strategies?

Tax planning strategies Tax planning strategies involve various techniques and approaches to legally minimize tax liabilities and optimize a taxpayer’s financial situation. Here are some common tax planning strategies: Income Deferral: Delaying the receipt of income to a later tax year, such as deferring bonuses or income from investments, can help lower your taxable income… Read More »