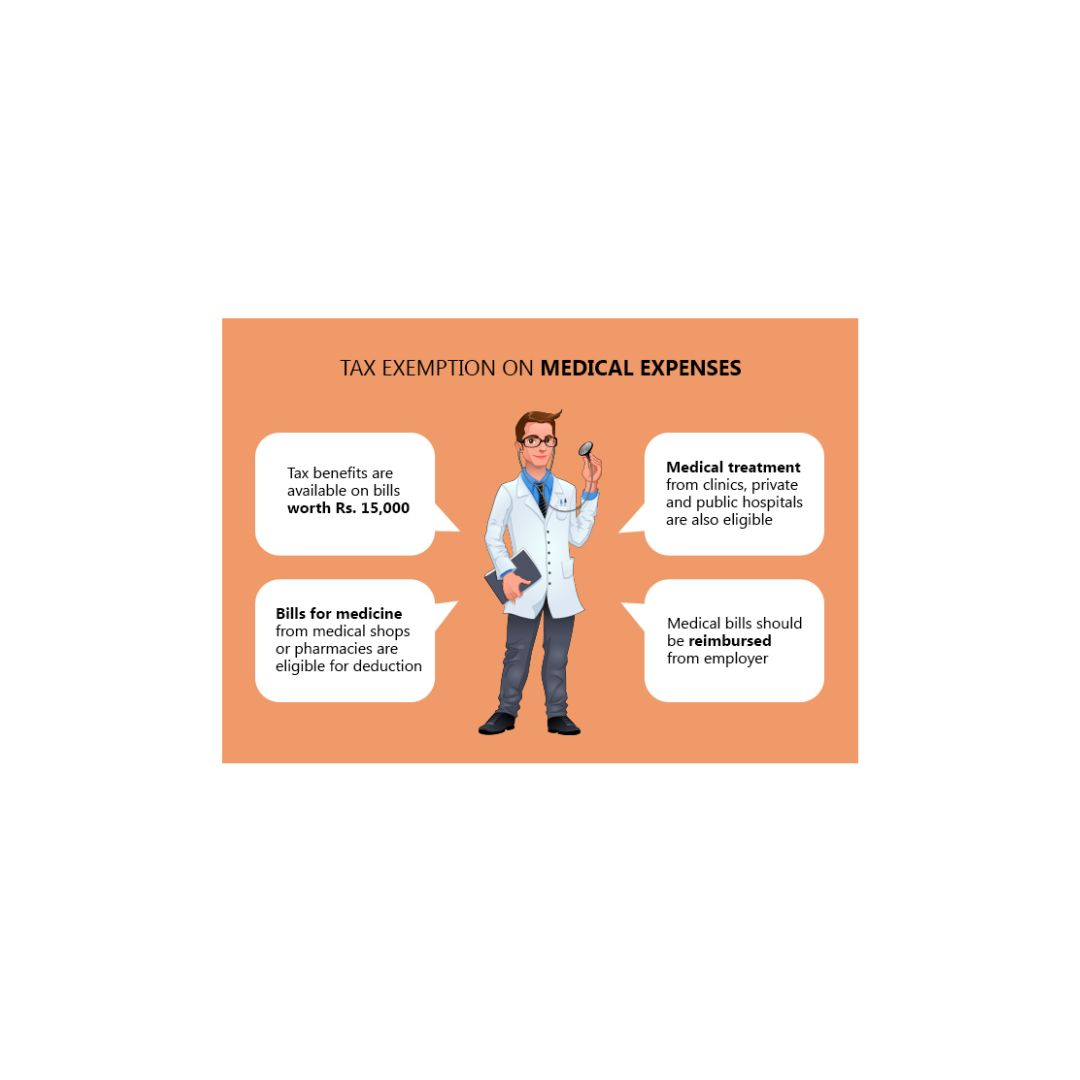

Tax planning is medium of reducing tax ?

Reducing tax Yes, tax planning is a method use to reduce tax liabilities legally and within the framework of tax laws and regulations. It involves analyzing an individual’s or business’s financial situation and using available tax strategies and incentives to minimize the amount of tax paid. The goal of tax planning is reducing tax position… Read More »