ITR 3 vs ITR 4 difference?

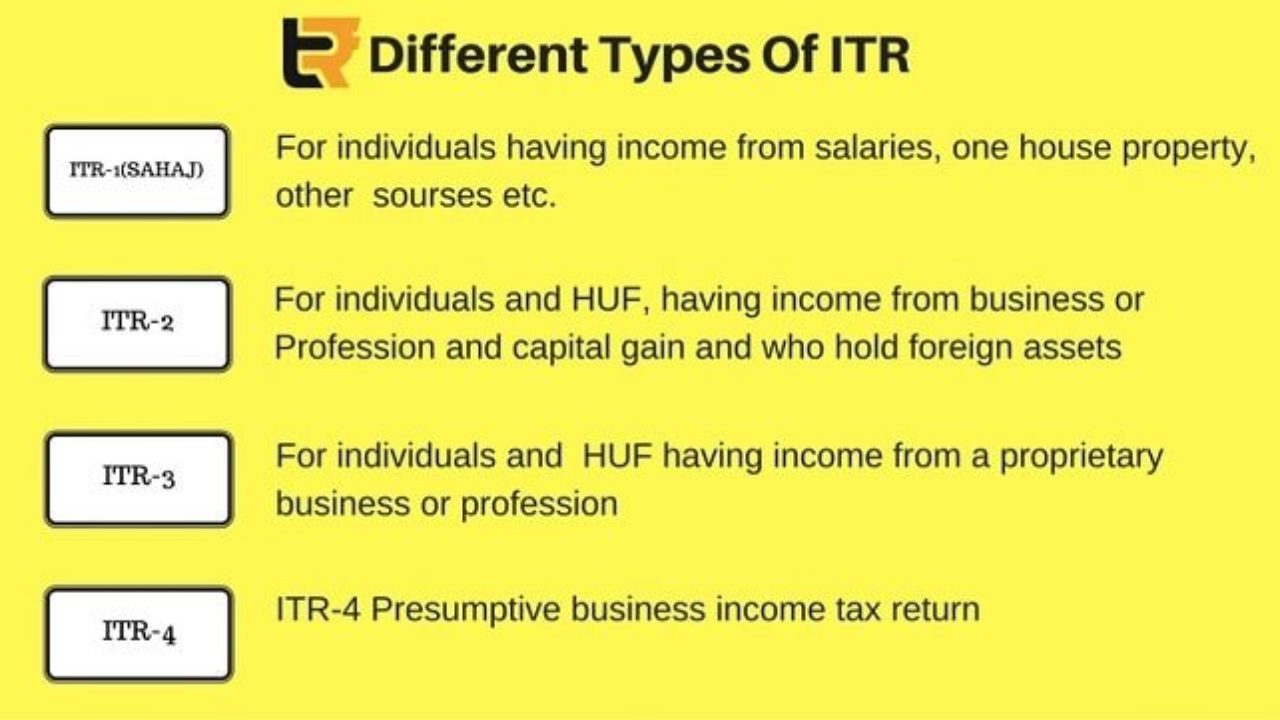

ITR 3 vs ITR 4 difference ITR 3 vs ITR 4 difference are two different income tax return forms in India, applicable to different types of taxpayers. Here are the key ITR 3 vs ITR 4 difference. Applicability: ITR-3: This form is specifically applicable to individuals and Hindu Undivided Families (HUFs) who generate income… Read More »