221 Is the GST composition scheme better than the regular scheme for retailers?

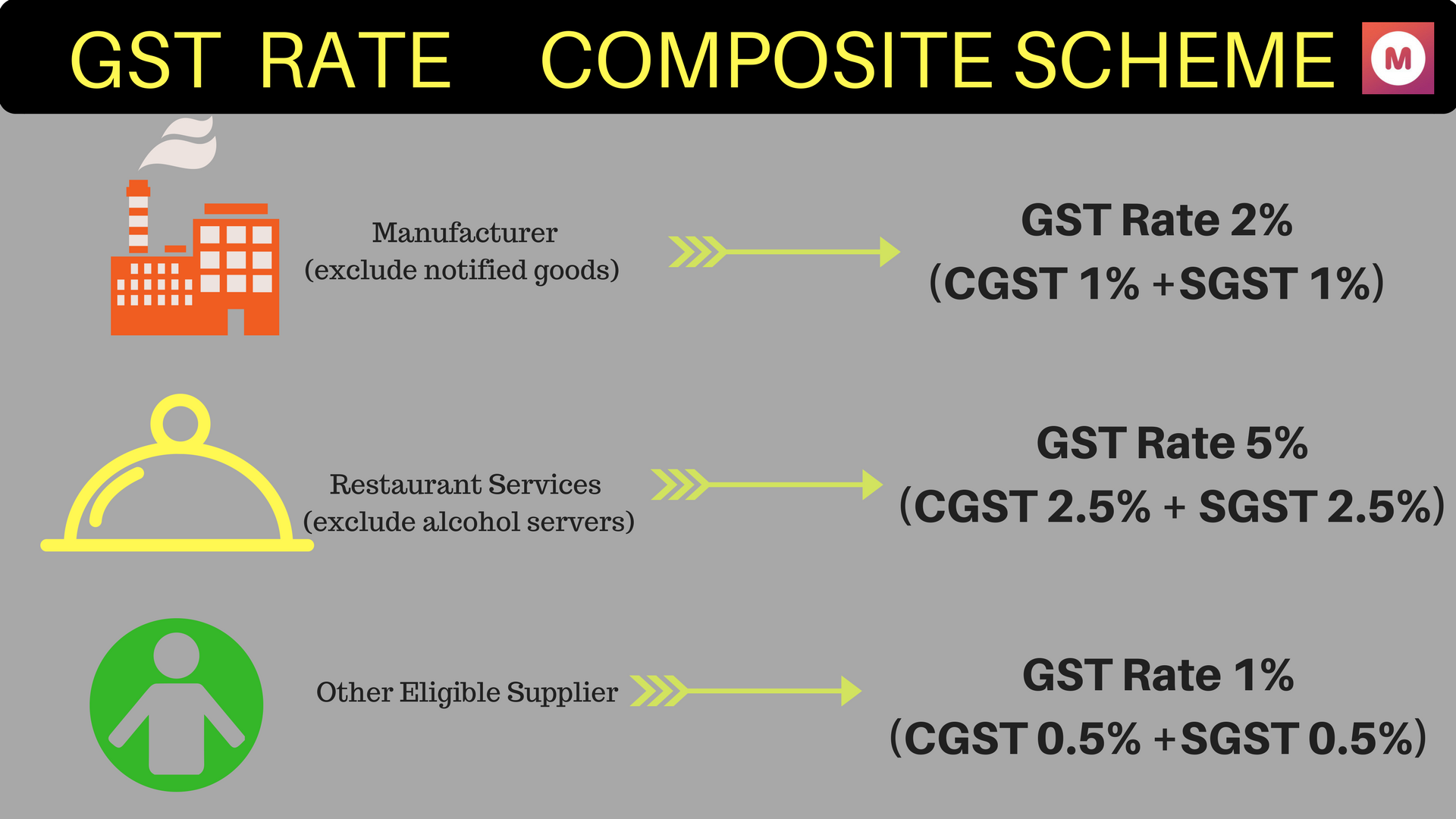

User Intent Retailers often struggle to choose between the GST Composition Scheme and the Regular GST Scheme. This article provides a step-by-step comparison to help them decide which option is better based on their business size, tax burden, and compliance requirements. Introduction GST is a crucial tax system in India, and businesses… Read More »