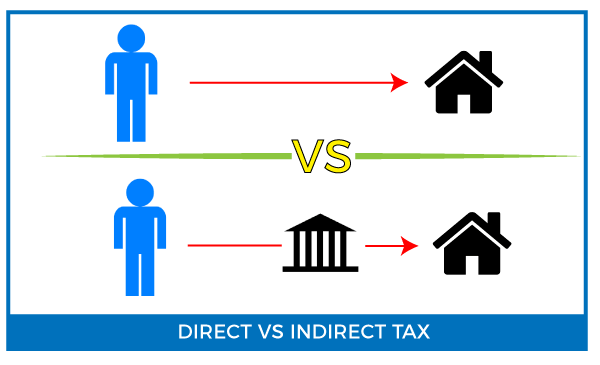

What is direct tax and indirect tax?

Indirect and Direct Tax Indirect and Direct tax is a type of tax that is imposed on the income or wealth of an individual or entity. It is called “direct” because the tax is levied directly on the person or entity that is liable to pay it. The tax liability cannot be shifted to… Read More »