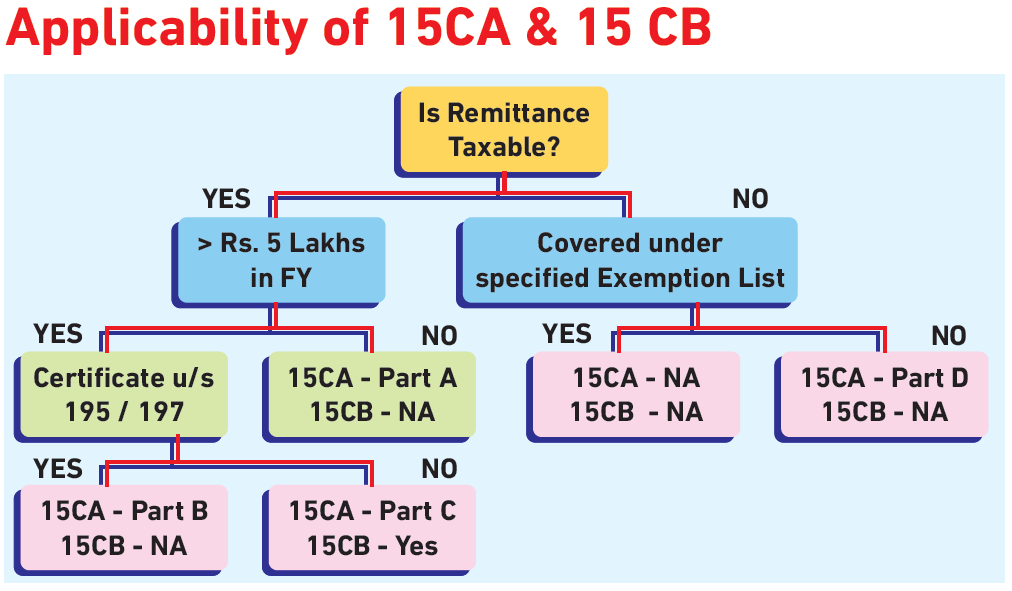

15CA/CB compliance?

15CA/CB Compliance 15CA/CB compliance involves adhering to the legal obligations established by the Indian government regarding the transfer of funds from residents to non-residents. It involves the submission of Form 15CA and obtaining Form 15CB to ensure proper reporting and taxation of cross-border transactions. To achieve 15CA/CB compliance, the following steps need to be… Read More »