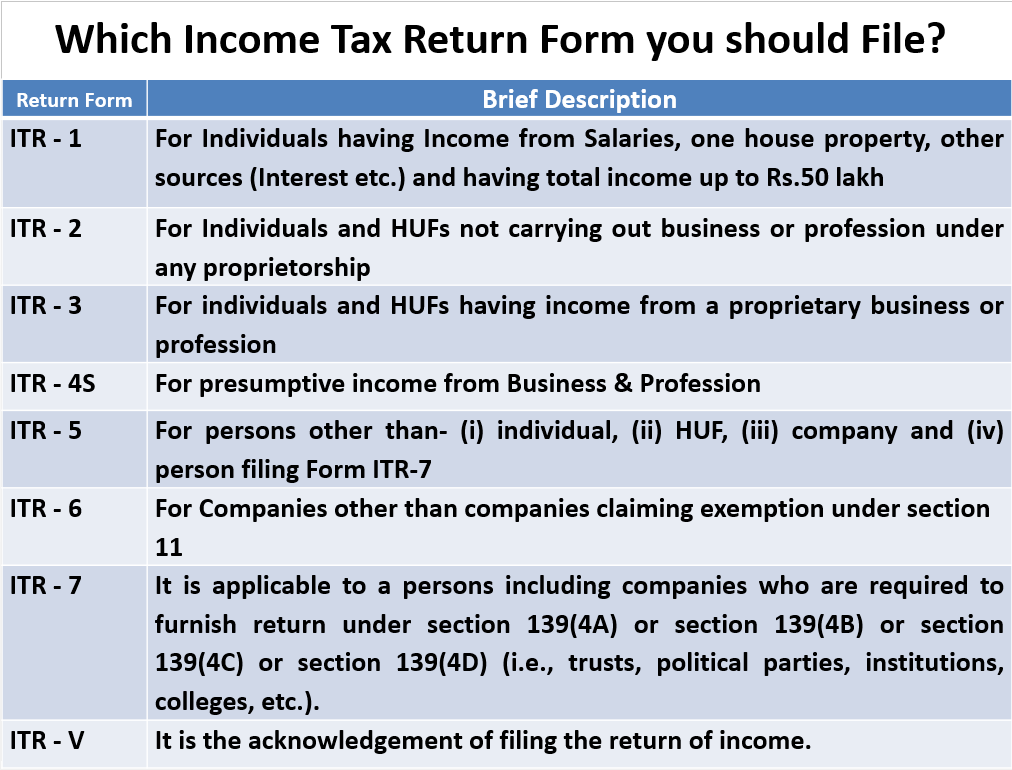

Who is eligible for ITR file ?

Eligible for ITR file In India, the following individuals and entities are generally eligible for filing an Income Tax Return (ITR): 1. Individuals with taxable income: Individuals who have earned taxable income during the financial year need to file an ITR. This includes salaried individuals, self-employed individuals, professionals, and freelancers. 2. Companies and firms:… Read More »