How to prepare projections for balance sheet?

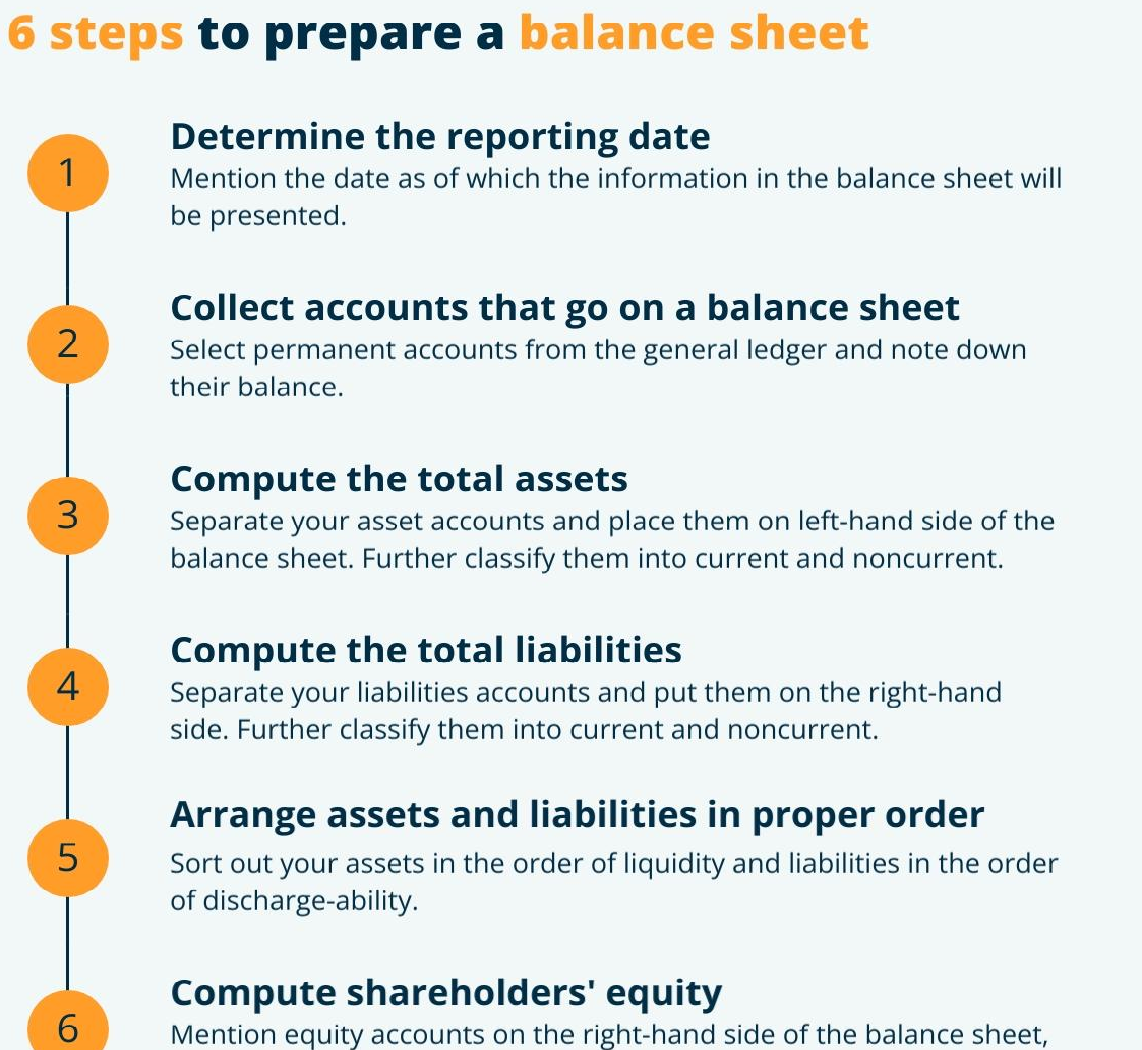

Preparing Projections for BalanceSheet Preparing projections for a balancesheet involves forecasting the financial position of a business at a future date based on anticipated data and assumptions. Here are the steps to prepare projections for a balance sheet: 1. Gather Historical Financial Data: Collect the past financial statements, including balance sheets, income statements, and… Read More »