When LLP is required ?

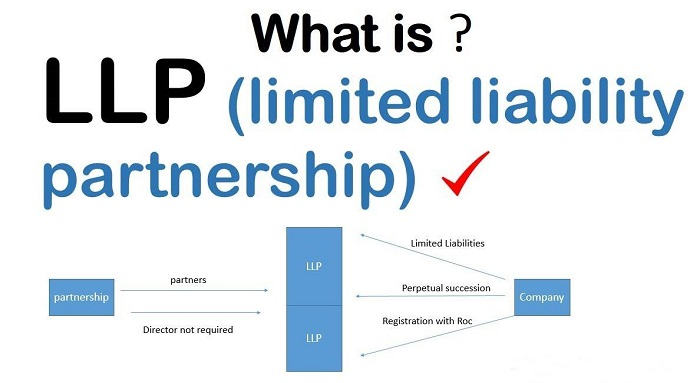

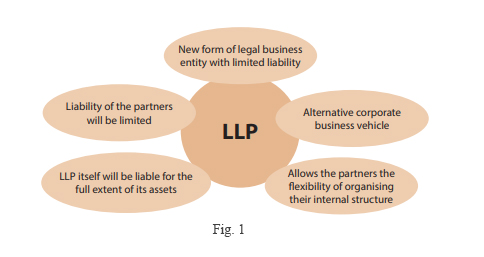

When LLP is required A Limited Liability Partnership (LLP) may be required in various situations depending on the jurisdiction and specific regulations. Here are some common scenarios where an LLP may be required: 1.Professional Services: In many jurisdictions, certain professional services such as legal, accounting, architectural, and consulting services are required to be… Read More »