Startup Registration

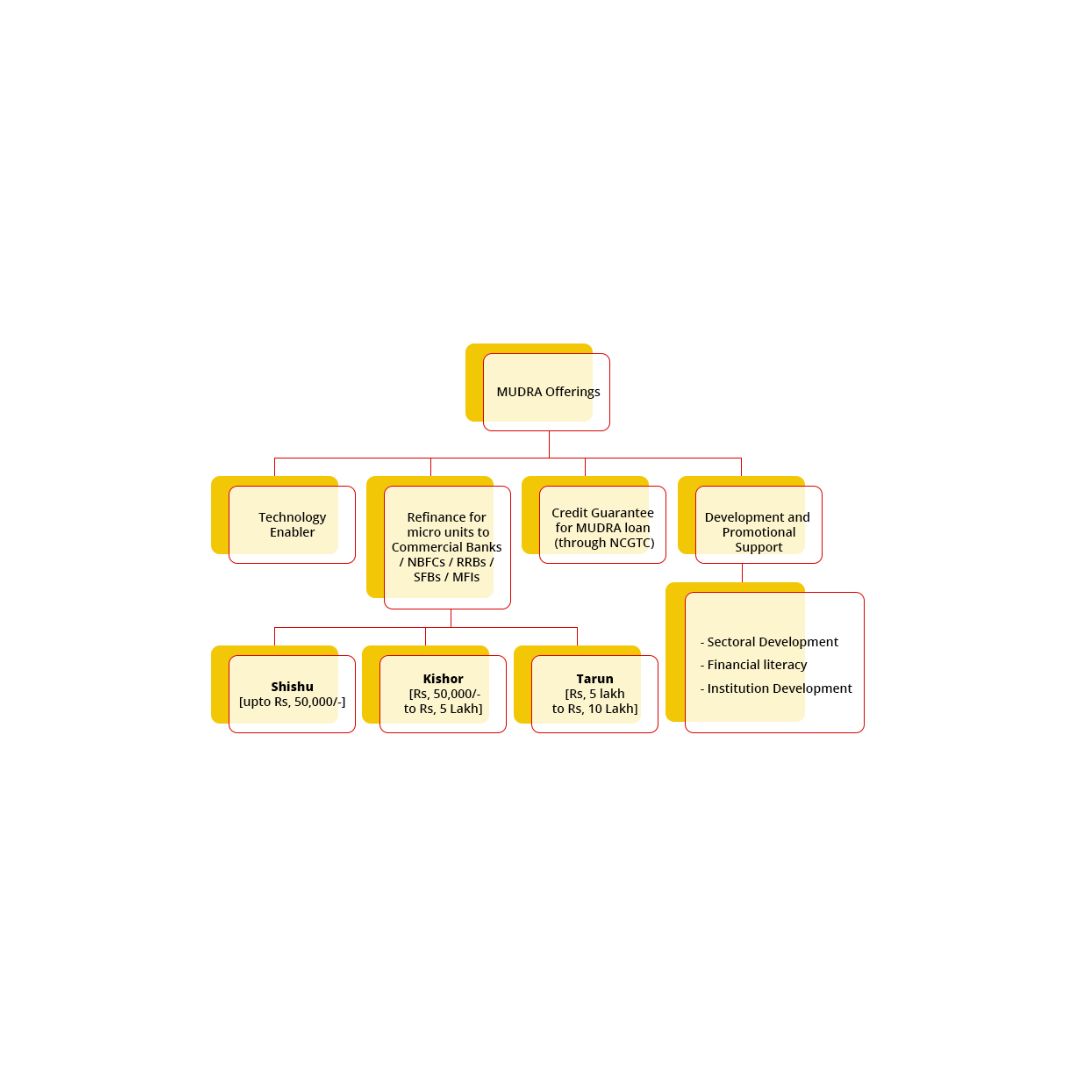

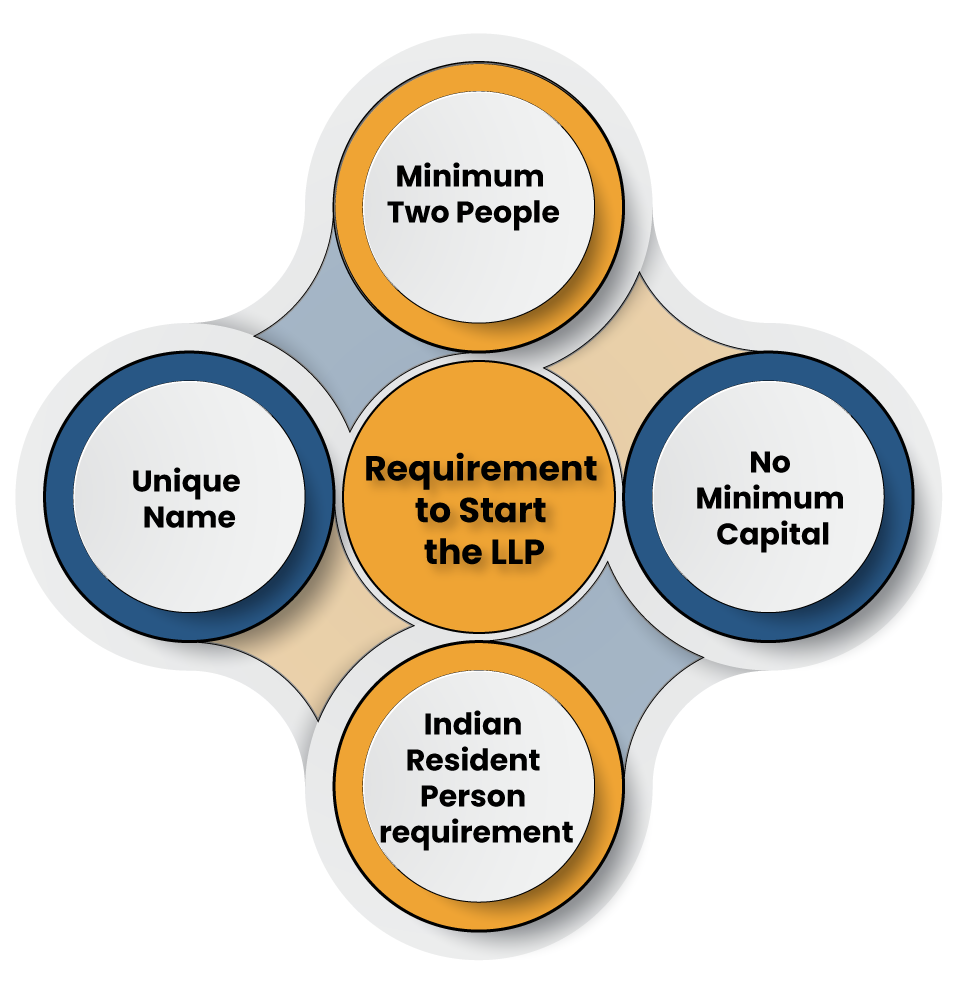

Startup Registration The business environment in India is dynamic, offering both opportunities and challenges for entrepreneurs and businesses. Opportunities: India boasts a large and growing consumer market, a diverse talent pool, and a rapidly expanding digital infrastructure. Key sectors such as technology, e-commerce, healthcare, education, and renewable energy present significant growth opportunities. Government initiatives such… Read More »