Can HUF claim 80c deduction?

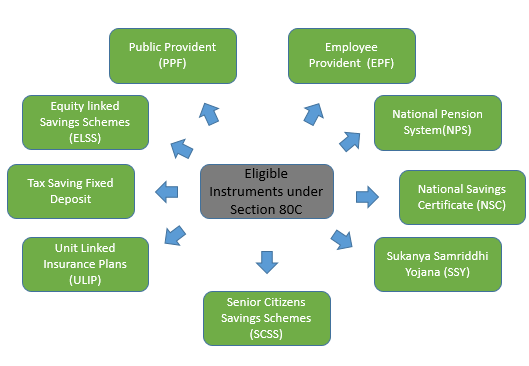

Can HUF Claim 80C Deduction In India, the Income Tax Act provides various avenues for taxpayers to claim deductions and reduce their taxable income. One of the most popular sections under which deductions are claimed is Section 80C. This section allows individuals and Hindu Undivided Families (HUFs) to claim deductions for investments and expenses, up… Read More »