What are the key financial statements audited for Freelancers?

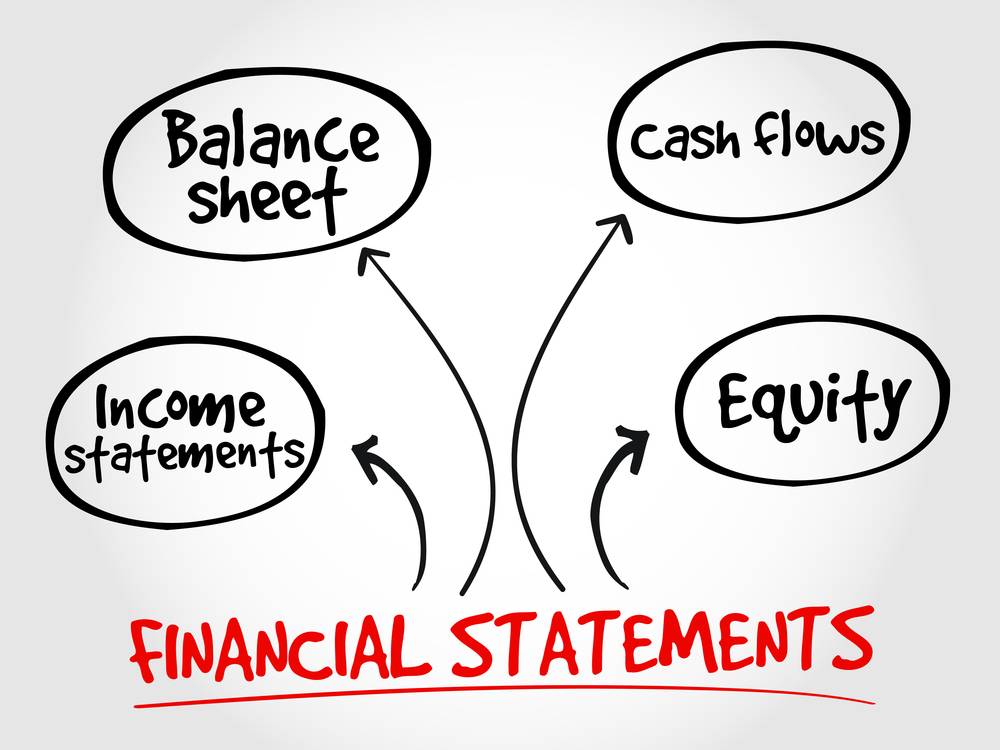

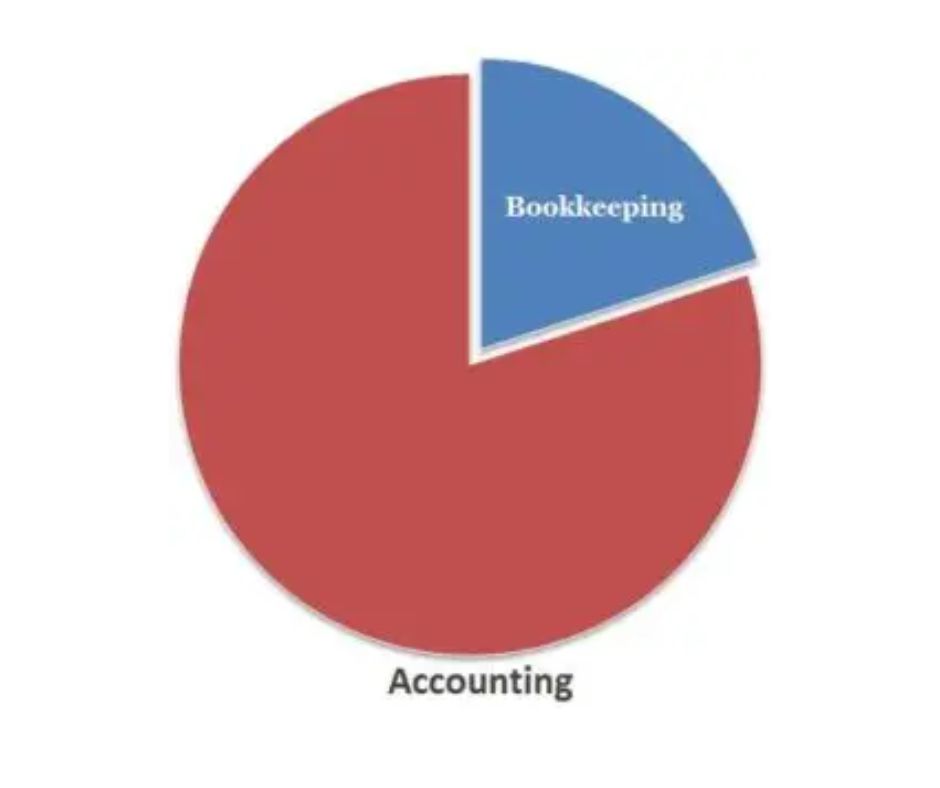

Financial Statements Audited for Freelancers Financial Statements Audited for Freelancers in India typically have a simplified financial structure compared to traditional businesses, which reflects in the key financial statements audited for them. The main financial statements audited for freelancers in India are: ◘ Income Statement: This statement provides a summary of the freelancer’s revenues and… Read More »