Mudra loan for small business?

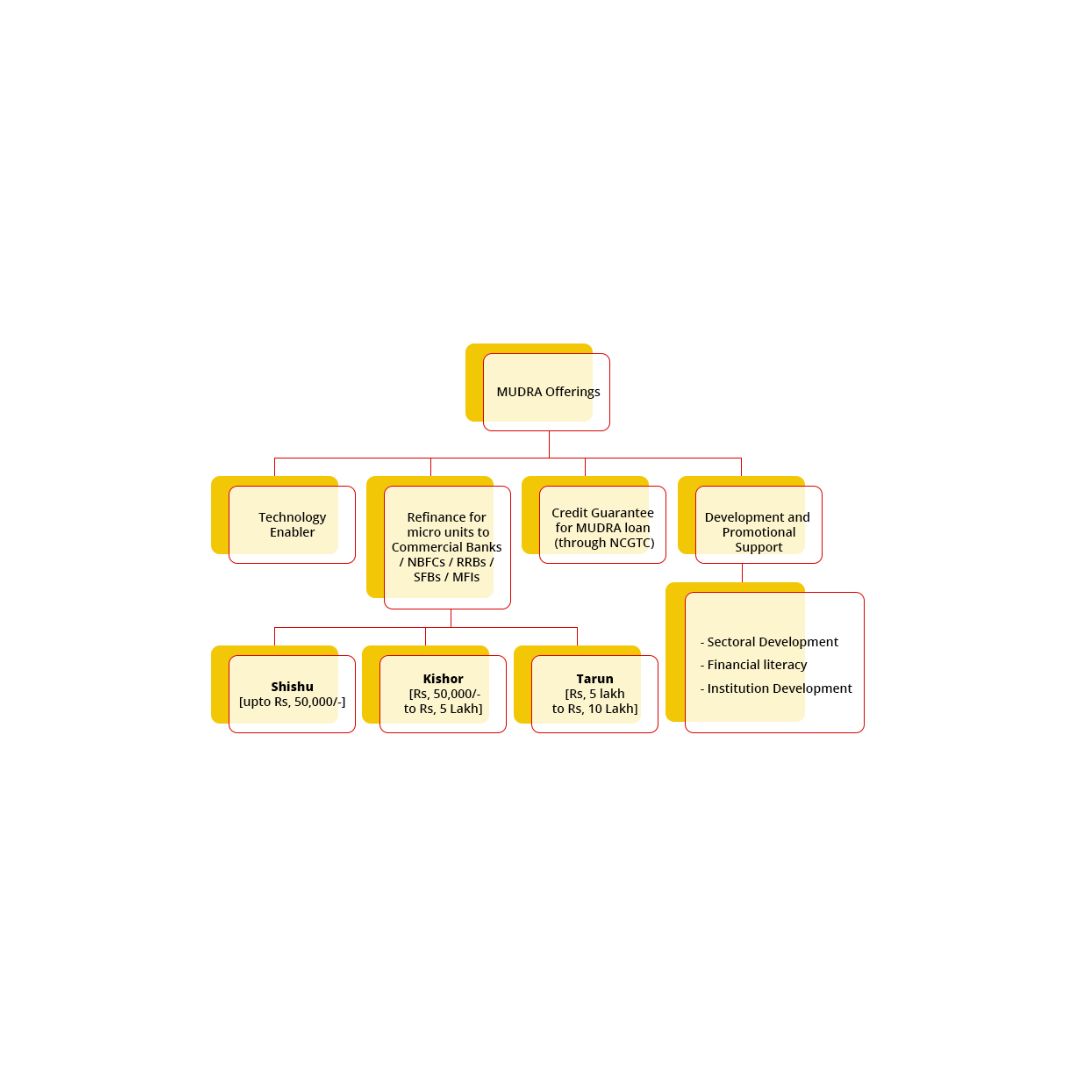

Mudra Loan for Small Business Mudra Loan for Small Business, The Government of India introduced the MUDRA (Micro Units Development and Refinance Agency) Loan scheme with the objective of extending financial support to mudra loan for small business, startups, and micro-enterprises. This initiative aims to facilitate access to much-needed funds for these entities, fostering… Read More »