Tax planning vs tax preparation?

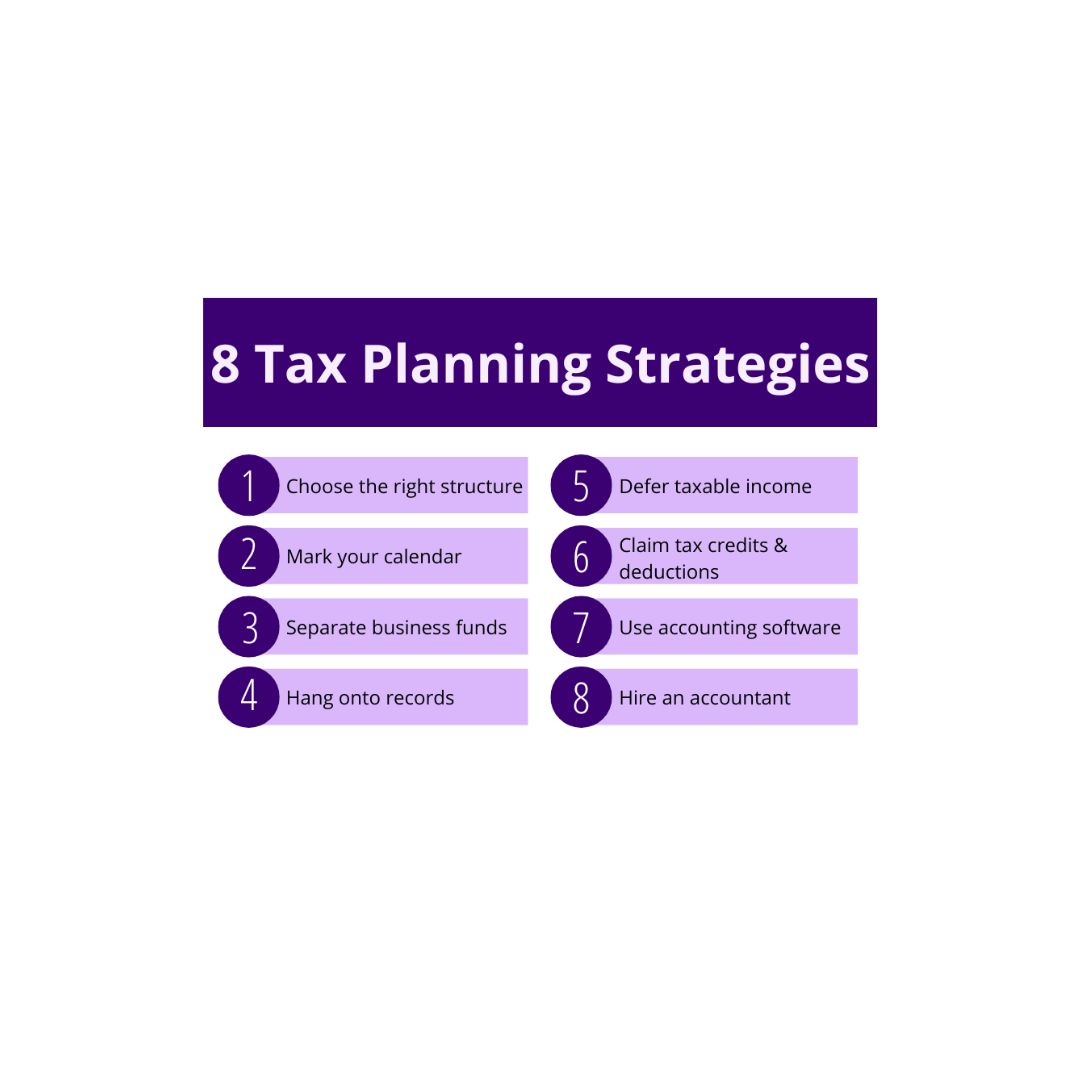

Tax Planning: Tax planning involves proactive strategies and actions taken throughout the year to minimize tax liability and optimize financial outcomes. It focuses on analyzing the taxpayer’s financial situation, exploring tax-saving opportunities, and implementing strategies to legally reduce taxes. Tax planning aims to strategically manage financial affairs, take advantage of applicable tax laws and provisions,… Read More »