Mudra loan project report?

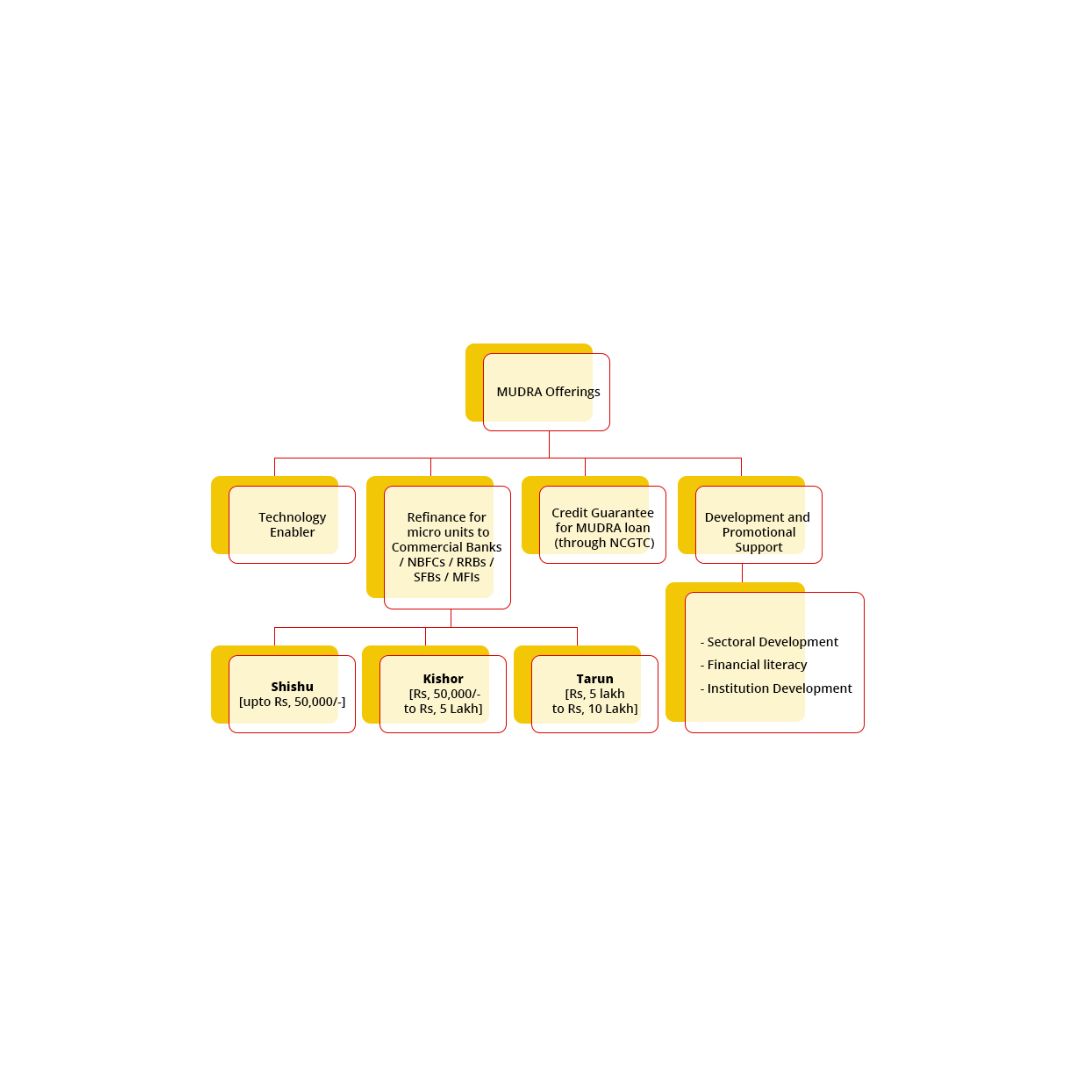

Entrepreneurship funding Entrepreneurship funding, “The format of a MUDRA (Micro Units Development and Refinance Agency) loan project report may vary depending on the requirements of the lending institution. However, here is a general outline that can serve as a reference for preparing a MUDRA loan project report: 1.Introduction Executive Summary: Provide a concise… Read More »