Who governs LLP?

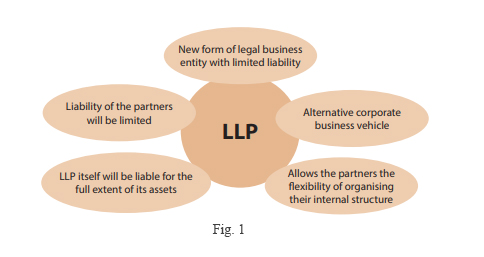

Who governs LLP Introduction An LLP, or Limited Liability Partnership, is a widely preferred business structure that merges the advantages of both partnerships and corporations. LLPs are commonly used by professionals and businesses seeking flexibility while limiting personal liability. However, every business entity operates within a legal framework, and LLPs are no exception. Governance is… Read More »