When is an LLP not tax transparent ?

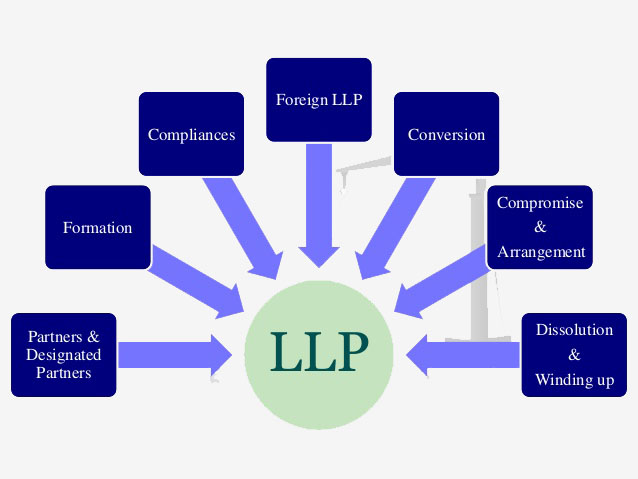

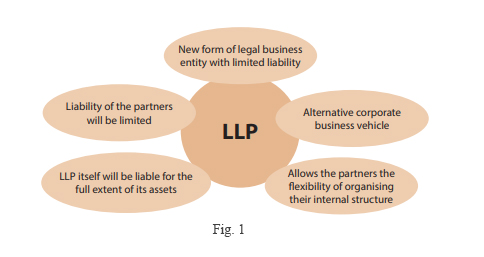

User Intent Users searching for this topic want to understand when a Limited Liability Partnership (LLP) loses its tax transparency status. They may be business owners, tax professionals, or legal advisors looking for specific tax implications of LLP structures in different jurisdictions. Introduction Limited Liability Partnerships (LLPs) are often considered tax-transparent entities, meaning the profits… Read More »