LLP is managed by?

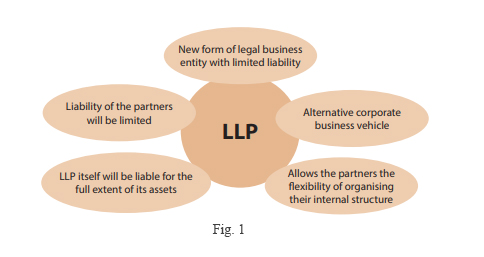

LLP is managed by A Limited Liability Partnership (LLP) is managed by its partners, who are collectively responsible for the management and operation of the LLP. The partners of an LLP may have different roles and responsibilities, which typically outline in the LLP agreement. Here are some key points regarding the management of… Read More »