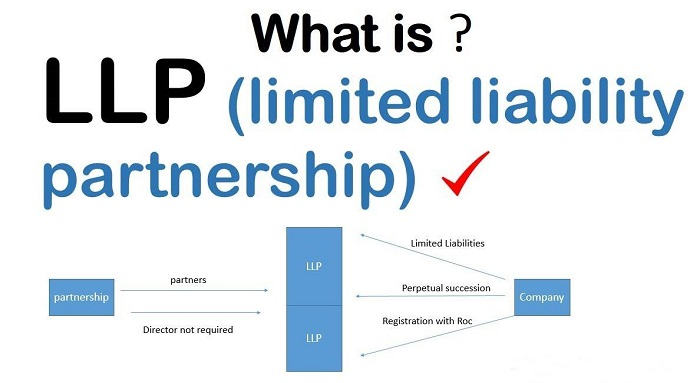

When LLP is applicable ?

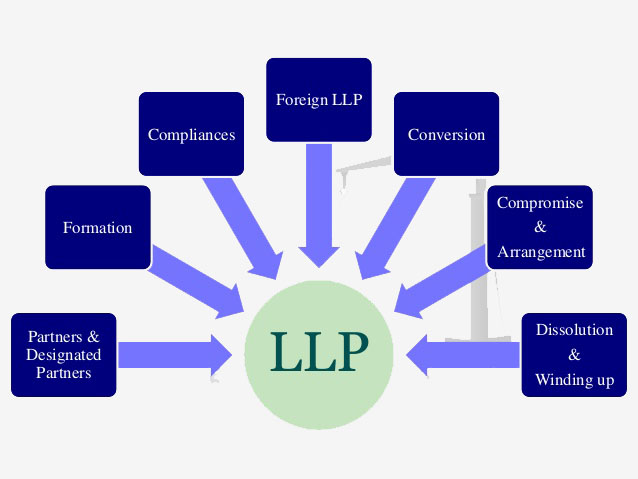

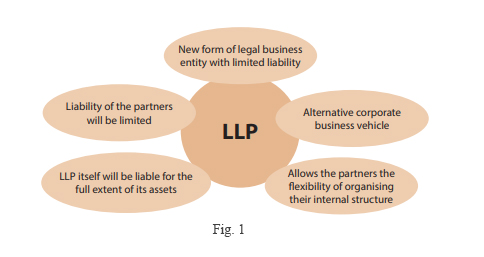

When LLP applicable When LLP applicable: Limited Liability Partnerships (LLPs) are applicable and suitable for various situations. Here are some common scenarios where an LLP may be applicable: Professional Services: LLPs are commonly used by professionals such as lawyers, accountants, architects, consultants, and similar service-oriented businesses. It allows these professionals to operate as a… Read More »