LLP Government Fees in India

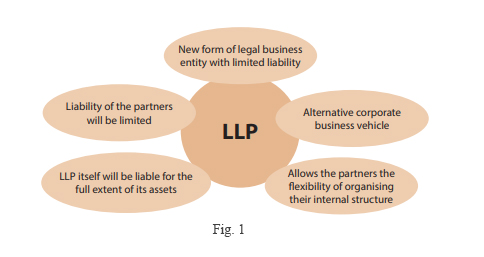

A Limited Liability Partnership (LLP) is a popular business structure in India due to its flexibility, minimal compliance requirements, and limited liability protection for partners. While registering and managing an LLP is cost-effective compared to a private limited company, there are several government fees involved at various stages of its lifecycle. Understanding these fees is… Read More »