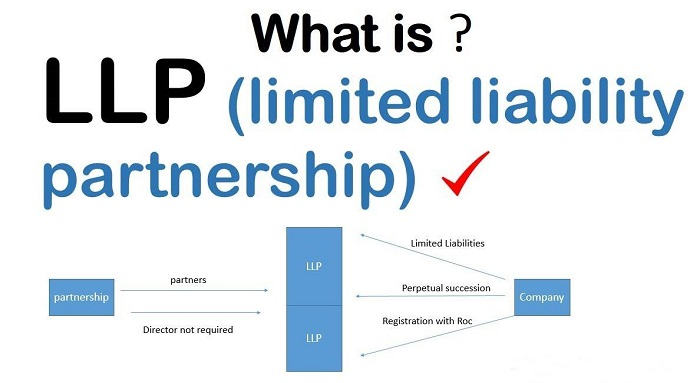

LLP what does it mean?

LLP definition LLP definition: LLP stands for “Limited Liability Partnership.” An LLP is a legal business structure that combines features of a partnership and a corporation, offering limited liability protection to its partners. In an LLP, partners are not personally liable for the debts and liabilities of the partnership beyond their agreed-upon investment or… Read More »