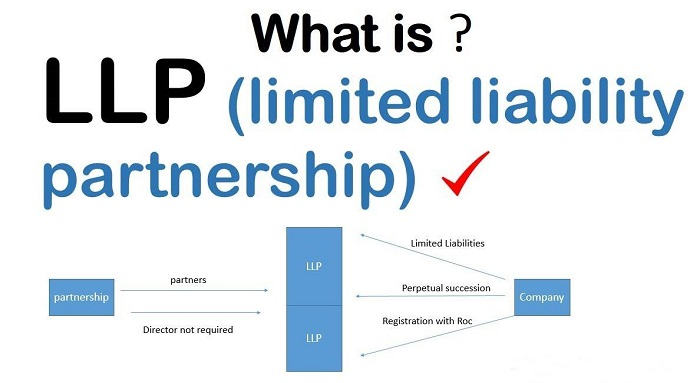

LLP are to be registered with?

LLP are to be registered with LLP are to be registered with: LLPs (Limited Liability Partnerships) typically need to be registered with the appropriate government agency or registrar in the jurisdiction where they operate. The specific registration requirements and procedures can vary depending on the country or region in question. Here are a few… Read More »