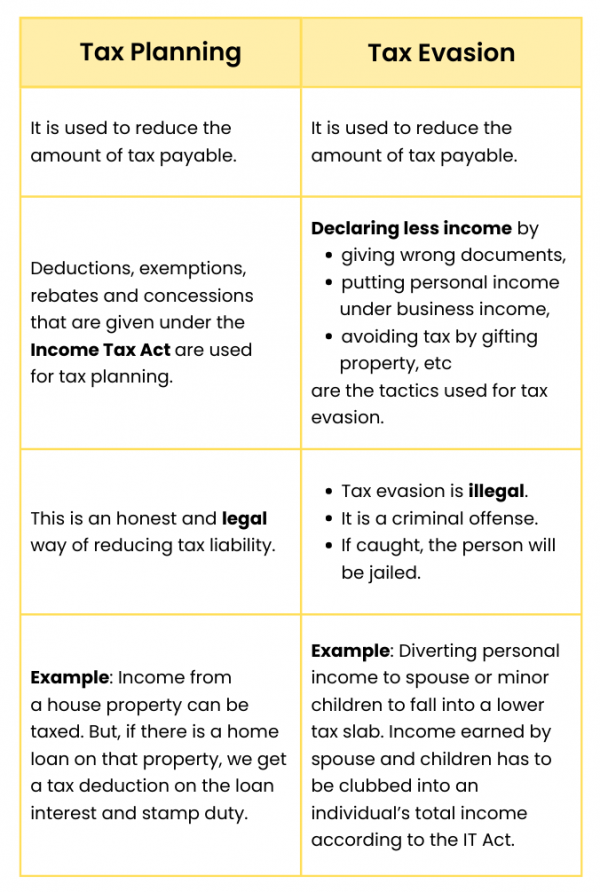

How tax planning is different from tax evasion?

TaxPlanning V/s TaxEvasion TaxPlanning V/s TaxEvasion are separate concepts with distinct consequences: Tax Planning: Tax planning refers to the legal and strategic arrangement of financial affairs to minimize tax liabilities within the boundaries of the law. It involves taking advantage of available tax deductions, exemptions, credits, and incentives to optimize your tax position.… Read More »