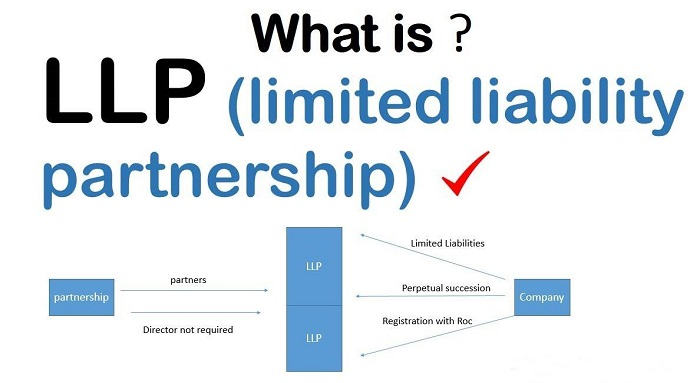

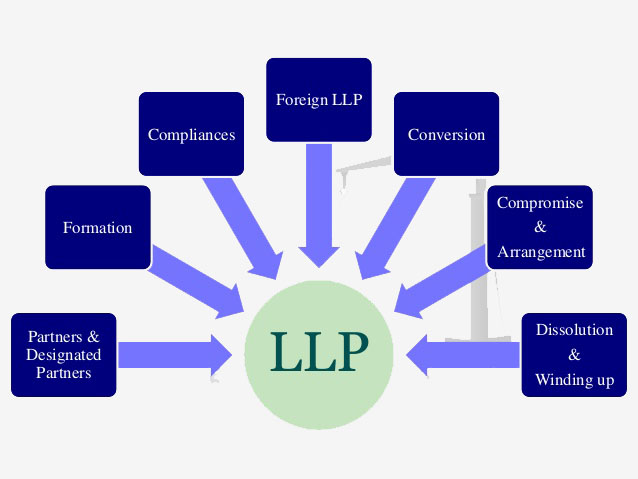

LLP to Ltd conversion: Why change from LLP to ltd ?

LLP to Ltd conversion LLP to Ltd conversion: The transition from a Limited Liability Partnership (LLP) to a Private Limited Company (Ltd) is driven by a diverse array of distinctive motives, reflecting the dynamic nature of businesses and the evolving needs of stakeholders involved in the decision-making process. Here, we explore a… Read More »