LLP ITR filing requirements: LLP to file which ITR ?

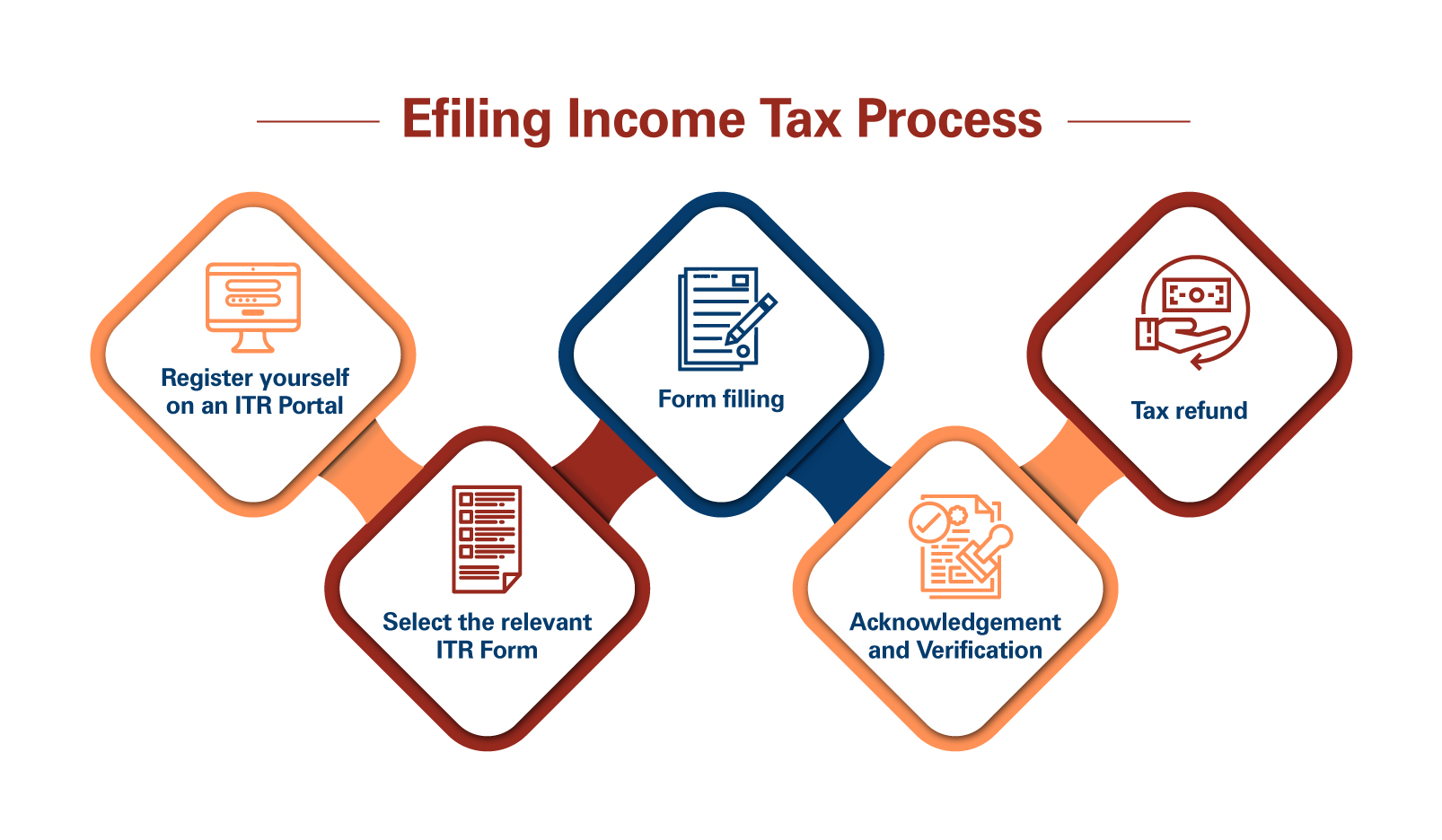

LLP ITR filing requirements Limited Liability Partnerships (LLPs) have gained popularity as a flexible and advantageous business structure for entrepreneurs and small businesses. However, like any other business entity, LLPs are subject to certain income tax filing requirements imposed by the tax authorities. Let’s explore this topic to understand the intricacies of LLP ITR… Read More »