Are computer repair and maintenance services eligible for income tax return (ITR) filing?

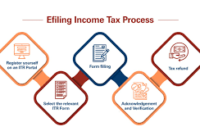

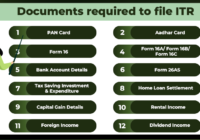

ITR for Computer Repair Running a computer repair and maintenance service business can be both rewarding and challenging. As a business owner in this industry, it’s crucial to understand your tax obligations and whether you need to file an Income Tax Return (ITR). This article delves into the eligibility and requirements for filing ITR… Read More »