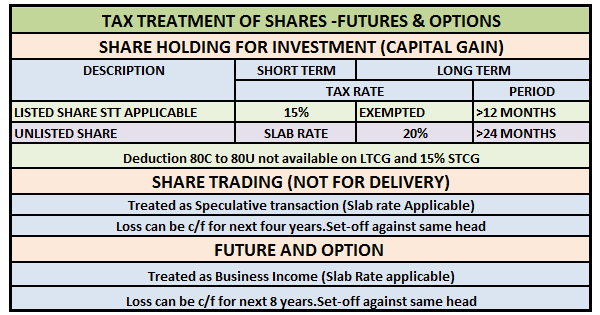

Which ITR to file for capital gains?

ITR for capital gains If you have capital gain, you will generally need to file ITR-2. Income Tax Return-2 is applicable for individuals and Hindu Undivided Families (HUF) who have income from sources other than business or profession. These are typically categorized as “Income from Capital Gains” in ITR-2. However, it is important to… Read More »