Why financial statements are prepared?

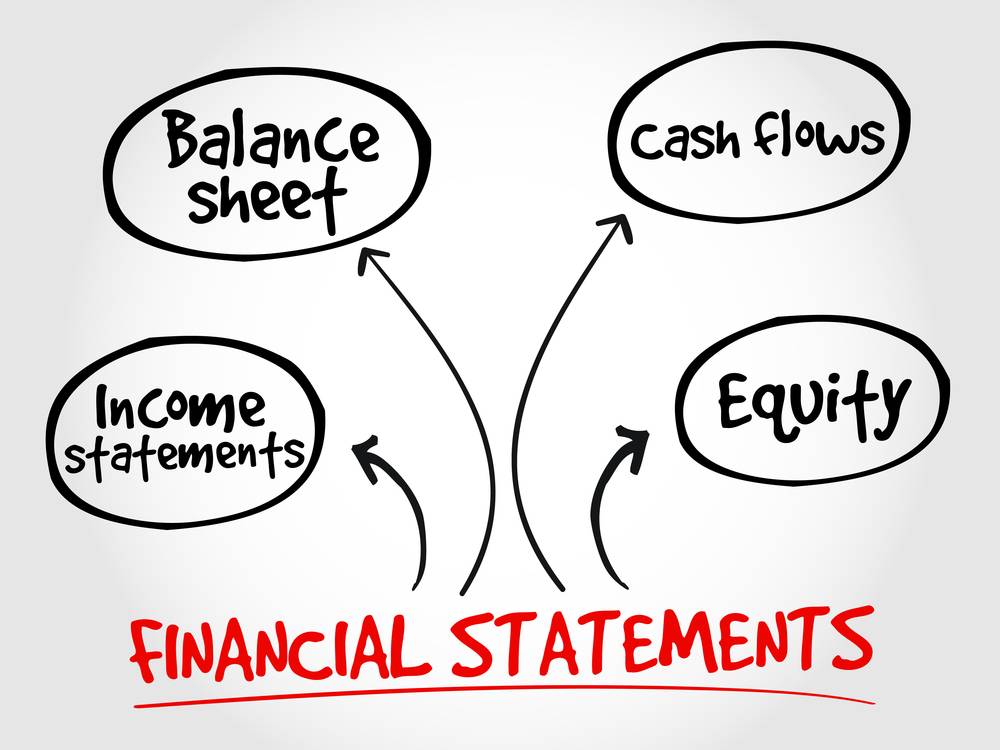

Why financial statements are prepared Financial Statements are Prepare, Company financial statements are usually craft by the accounting and finance department of the company, comprising proficient accountants, financial analysts, and other experts well-versed in financial reporting. The Financial Statements are Prepare encompasses various stages, which include: 1.Gathering Financial Data: The accounting team collects and… Read More »