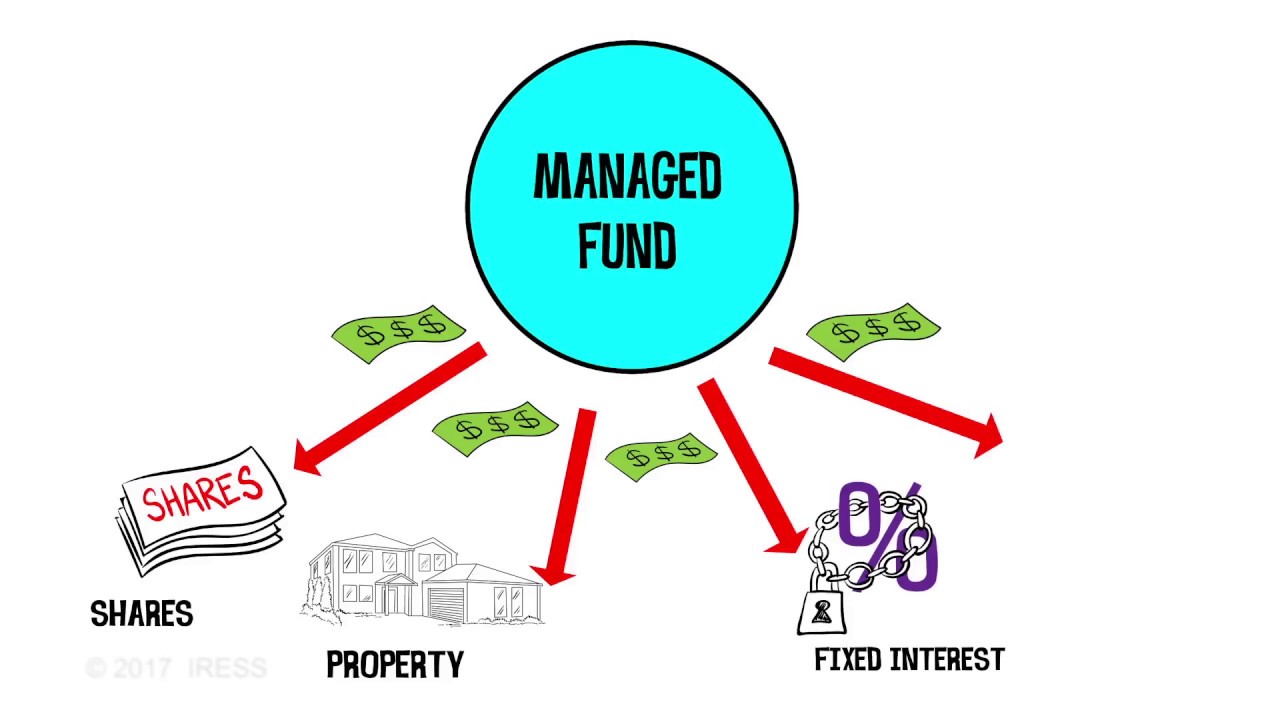

Is a managed fund worth it?

Managed Fund Whether a managed fund is worth it depends on various factors and individual preferences. Here are some considerations to help you evaluate the worth of a managed fund: 1. Professional Expertise: These funds are typically managed by professional fund managers who have expertise in investment strategies and market analysis. If you lack… Read More »