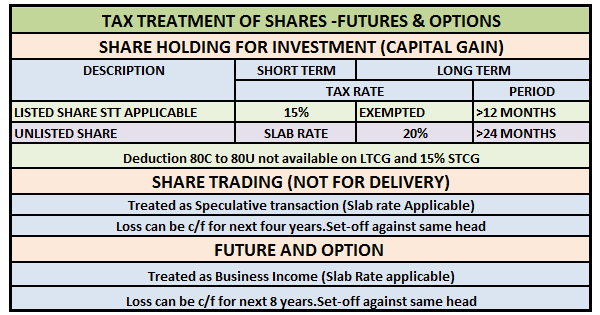

What are the tax implications of future trading?

Introduction Futures trading is an attractive option for investors looking to hedge risks or speculate on price movements. However, traders often overlook the tax implications associated with futures contracts, which can significantly impact profits and financial planning. Understanding these tax rules is essential for traders to maximize gains while ensuring compliance with… Read More »