What are the requirements for an investment to be eligible for tax benefit under Section 80C of the Income Tax Act?

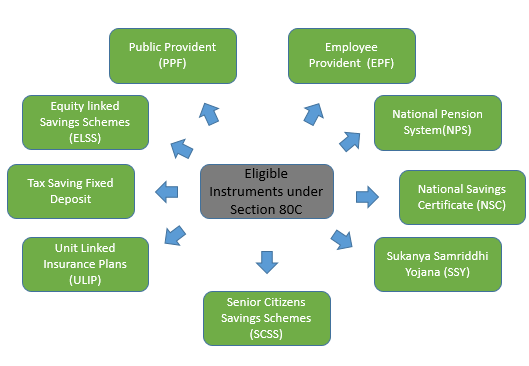

Tax benefit under Section 80C Understanding Tax Benefits Under Section 80C of the Income Tax Act Tax planning is crucial for optimizing savings and reducing tax liabilities. One of the most popular sections for claiming deductions is Section 80C of the Income Tax Act. To take advantage of these benefits, it’s essential to understand… Read More »