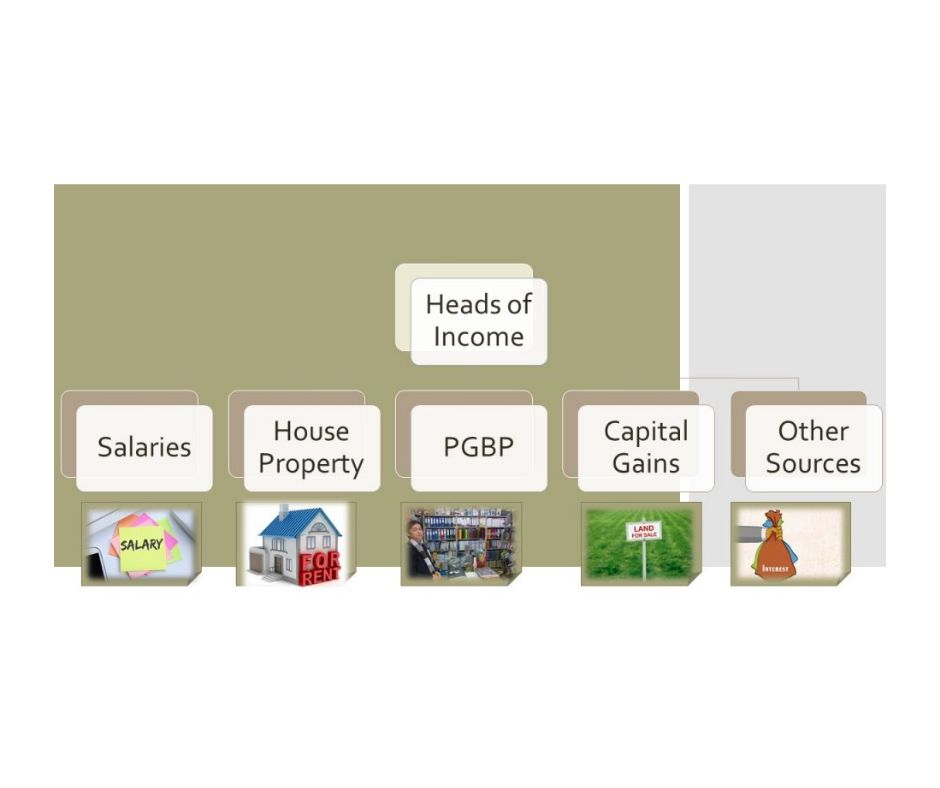

Heads of income: How many heads are there under total income?

Heads of income Under the concept of total income, there are various heads or categories of income that are considered for the purpose of computing an individual’s or a business’s overall income. The specific heads of income may vary depending on the tax laws and regulations of a particular country. However, the common heads of… Read More »