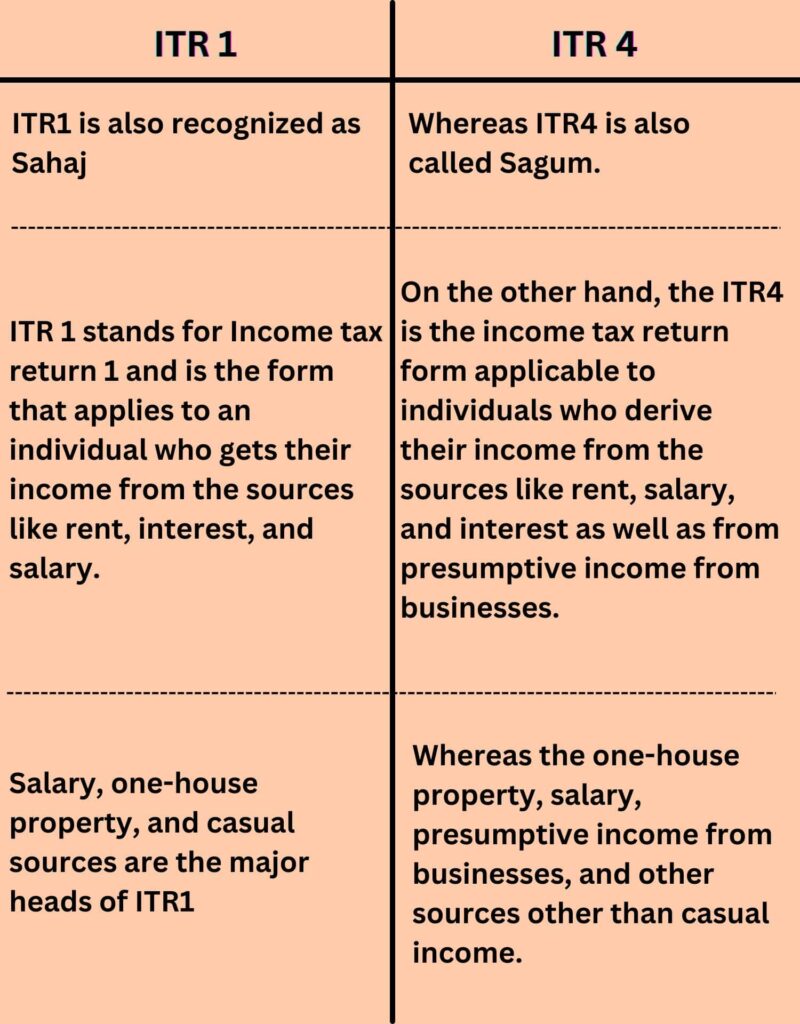

ITR 1 Vs. ITR 4?

ITR 1 Vs. ITR 4 ITR 1 Vs. ITR 4 are two different income tax return forms in India, applicable to different types of taxpayers. Here are the key differences between ITR-1 (Sahaj) and ITR-4 (Sugam): Applicability: ITR-1: It is applicable to individuals who are residents of India and have income from salary, one house… Read More »