Does everyone need to file ITR?

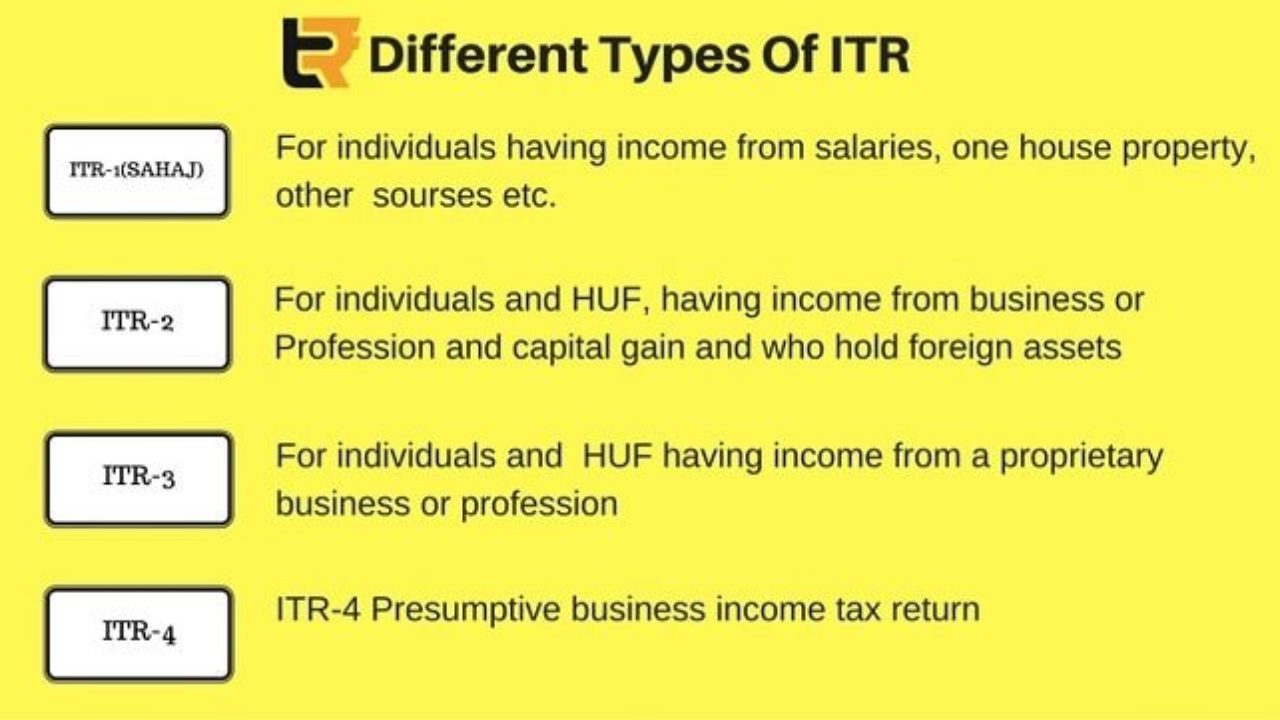

Filing ITR Filing ITR, In India, not everyone is required to file an income tax return (ITR). The requirement to file an ITR depends on various factors, including the individual’s age, income level, and the type of income earned during the financial year. Here are some general guidelines regarding who needs to file Filing ITR:… Read More »