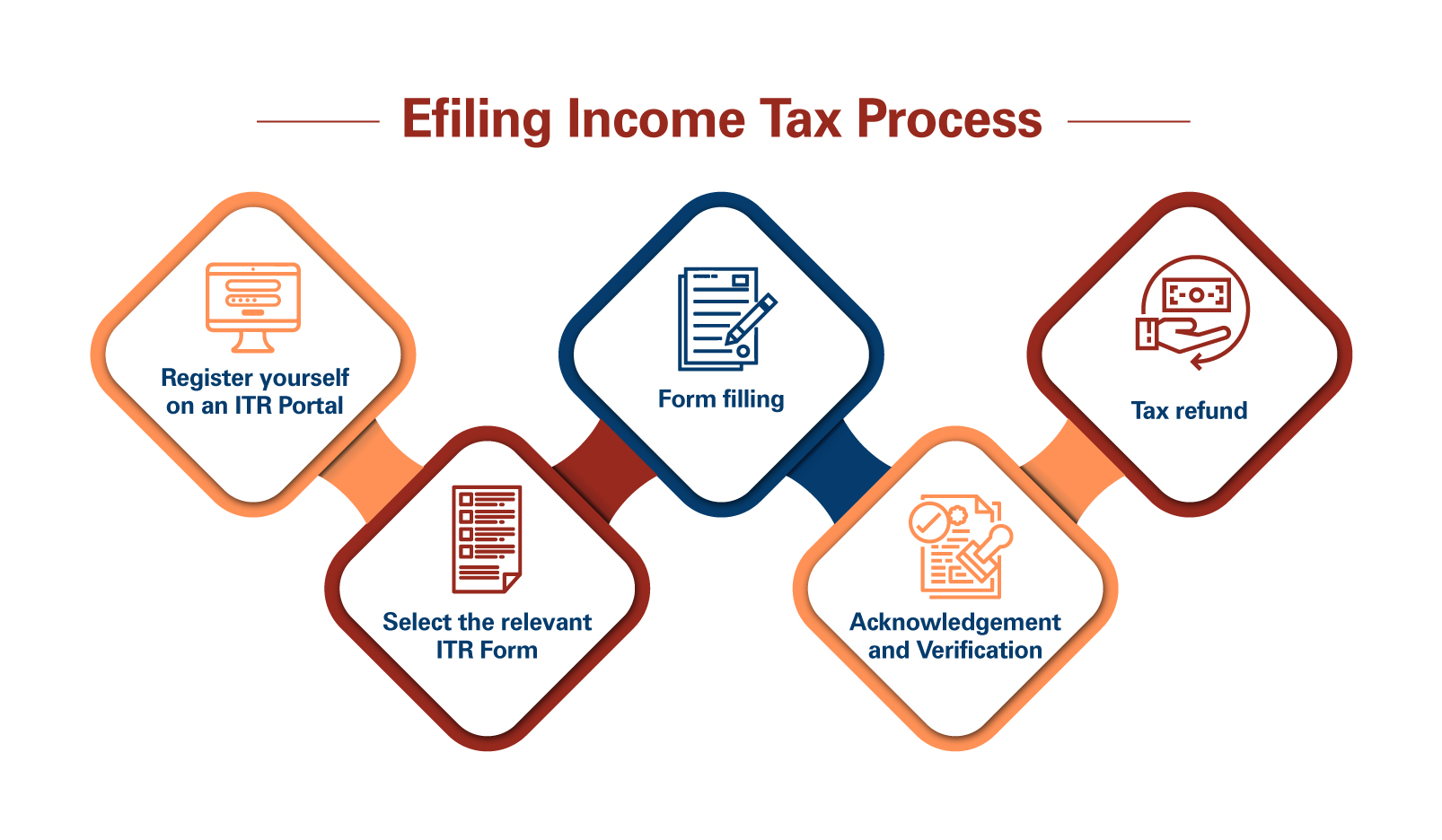

ITR filing is mandatory in 10 situations?

ITR Filing is Mandatory Income tax return (ITR) filing is mandatory in several situations in India. Here are ten common scenarios where individuals are required to file their ITR: ITR filing is mandatory in 10 situations: 1. Income above Basic Exemption Limit: If your total income before claiming any deductions exceeds the basic exemption… Read More »