How should restaurants and hotels classify their income for ITR purposes?

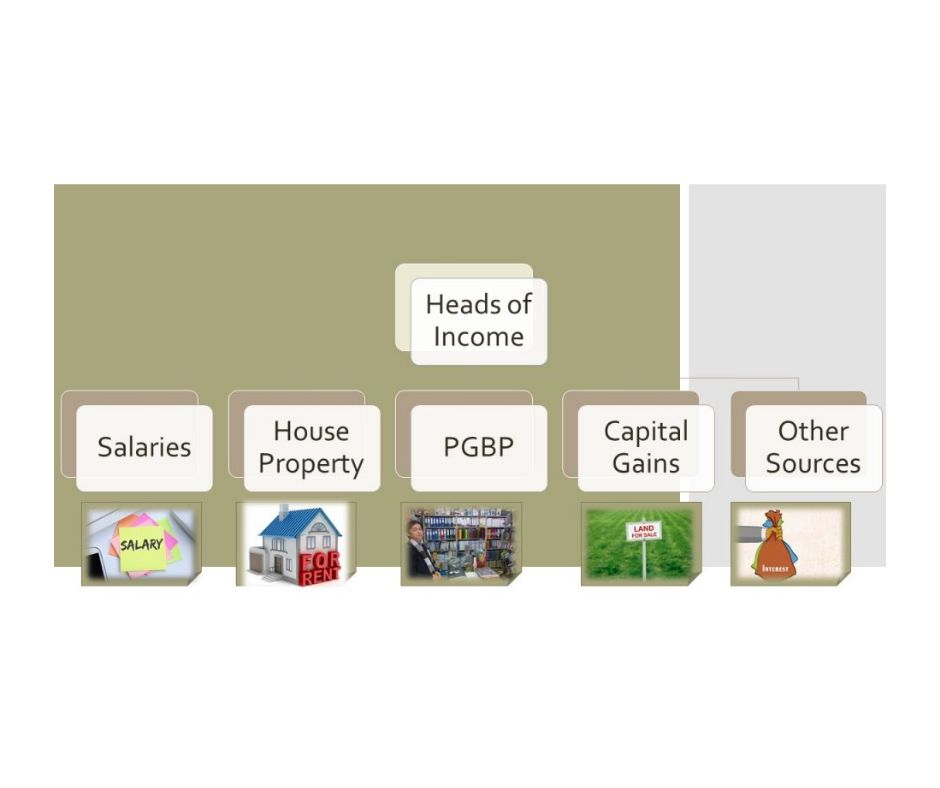

ITR Revenue Categorization ITR Revenue Categorization, Restaurants and hotels need to categorize their earnings as either ‘business income’ or ‘professional income’ when filing for ITR. Business income is the income that a business derives from its operations, while professional income is the income that a professional derives from their services. In general, restaurants and… Read More »