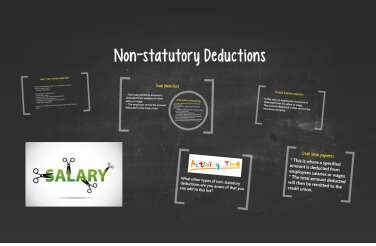

What are examples of non-statutory deductions?

Non-statutory deductions Non-statutory deductions also known as voluntary deductions, are deductions that are not required by law but are made from an employee’s wages or salary at their request. Examples include: 1.Health and life insurance premiums 2.Retirement plan contributions 3.Union dues or professional association fees 4.Charitable contributions 5.Wage advances or loans 6.Uniforms or work-related equipment… Read More »