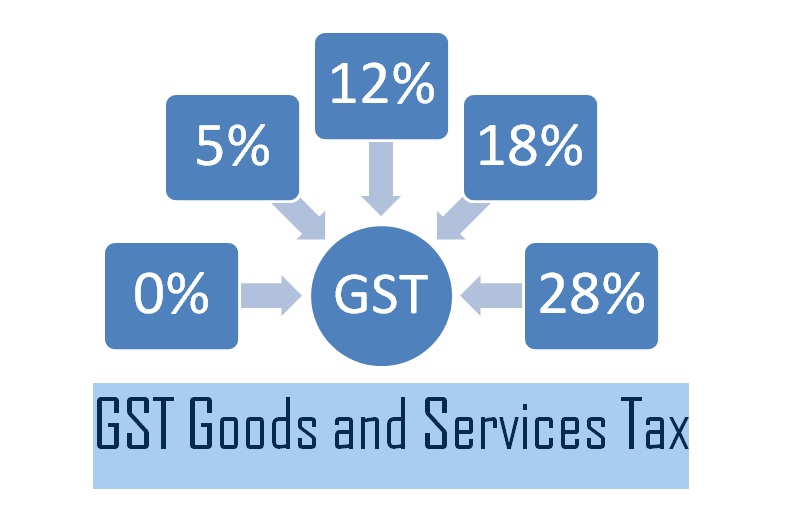

GST Regulations

GST Regulations Here are some key for GST Regulations: 1. GST Compliance: Goods and Services Tax (GST) is a significant tax regime in India that applies to the supply of goods. Wholesalers must ensure they are correctly calculating and collecting GST on their sales. They should maintain accurate records of GST collected and paid,… Read More »