How mudra loan works in India?

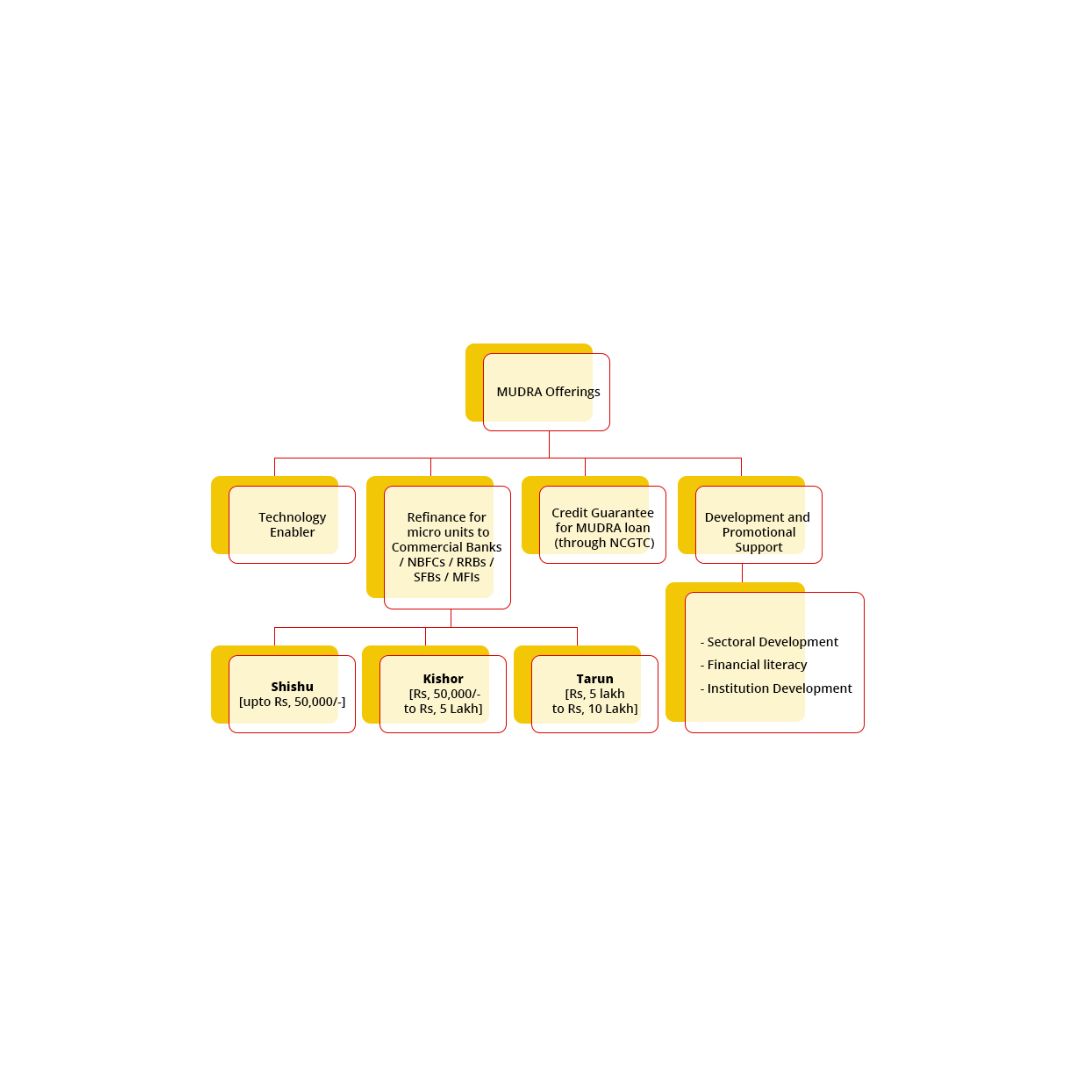

MudraLoan in India MudraLoan in India function as a means of offering financial assistance to small businesses and entrepreneurs through a range of financial institutions. Overview of how mudra loan work in India: 1. Loan Categories: MUDRA loans are divided into three categories based on the stage and funding needs of the business: a.… Read More »