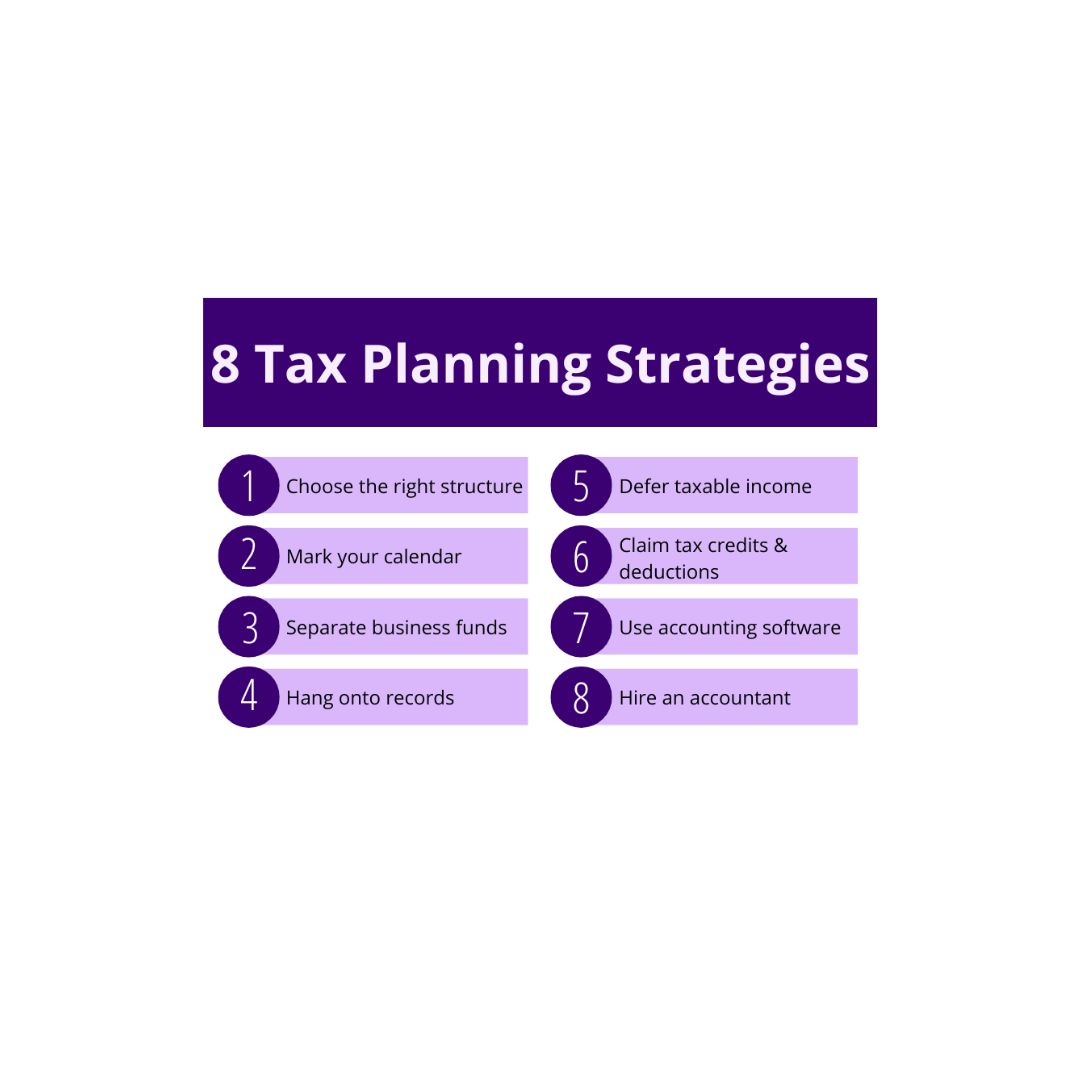

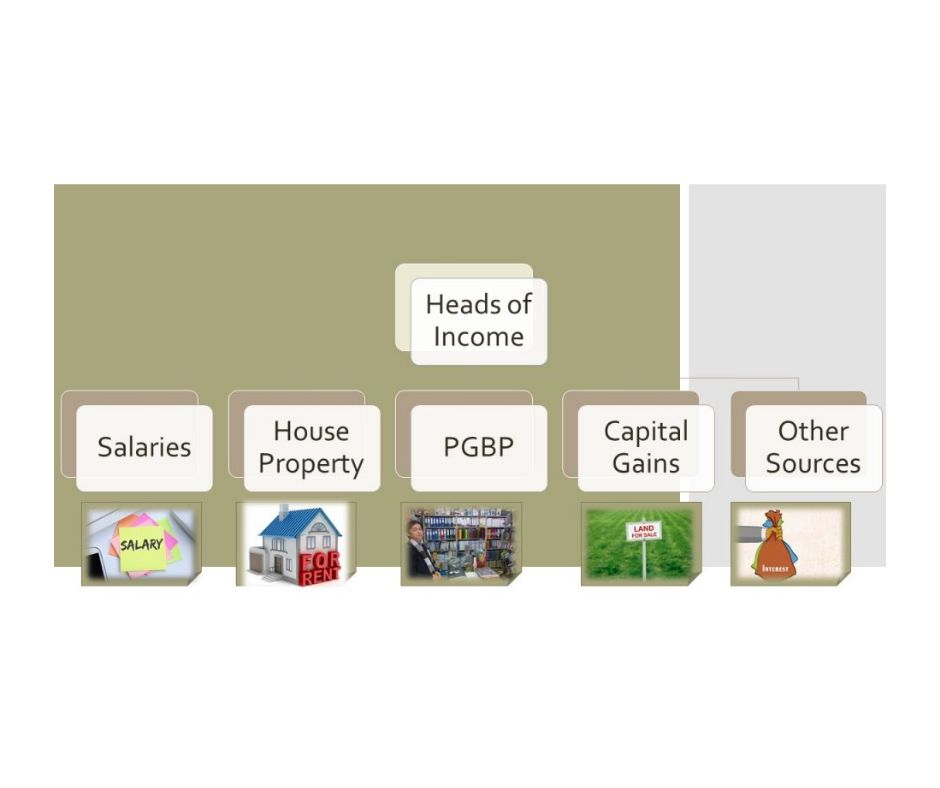

Tax planning vs tax compliance?

Tax planning vs tax compliance Tax planning vs tax compliance, Here’s a comparison between tax planning and tax compliance: Taxation Planning: Tax planning involves strategic decision-making and the implementation… Read More »