Annual Impairment Testing of Assets: Which assets are required to be tested for impairment Annually ?

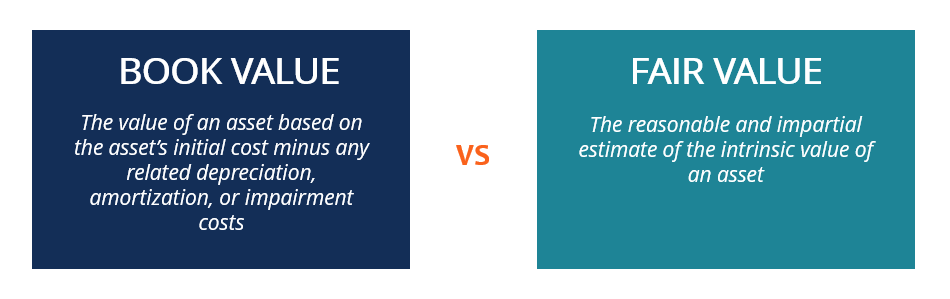

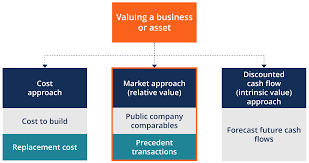

Annual Impairment Testing of Assets Under accounting standards such as the International Financial Reporting Standards (IFRS) and Generally Accepted Accounting Principles (GAAP), certain assets require to test for impairment annually. Impairment testing involves assessing whether the carrying value of an asset exceeds its recoverable amount, which is the higher of its fair value less costs… Read More »