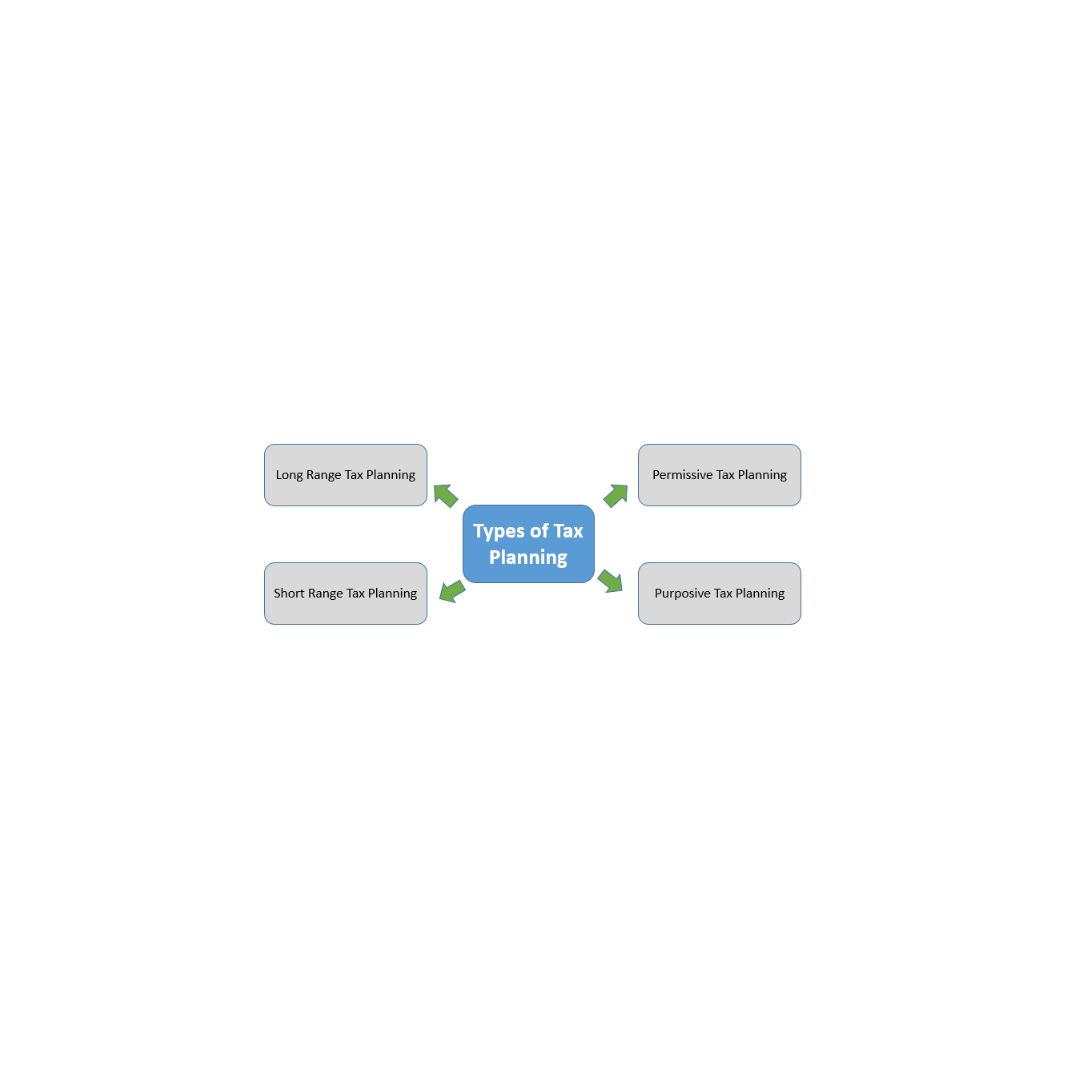

Tax planning for companies?

Tax planning for companies Tax planning for companies,Tax planning for companies is essential to optimize tax efficiency, reduce tax liabilities, and ensure compliance with relevant tax laws. Here are some key considerations for tax planning for companies: Understand the Tax Framework: Familiarize yourself with the tax laws, regulations, and provisions applicable to your jurisdiction. This… Read More »