Asset verification Meaning?

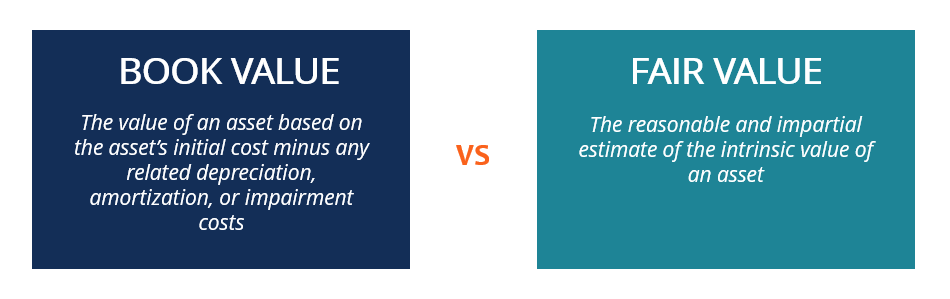

Asset verification Asset verification refers to the process of confirming the existence, ownership, and value of assets held by an individual, organization, or entity. It involves conducting a thorough examination and assessment of various types of assets. Such as real estate, vehicles, equipment, inventory, financial investments, and intellectual property, among others. The purpose of assets… Read More »