What are the requirement 15CA/CB certificate?

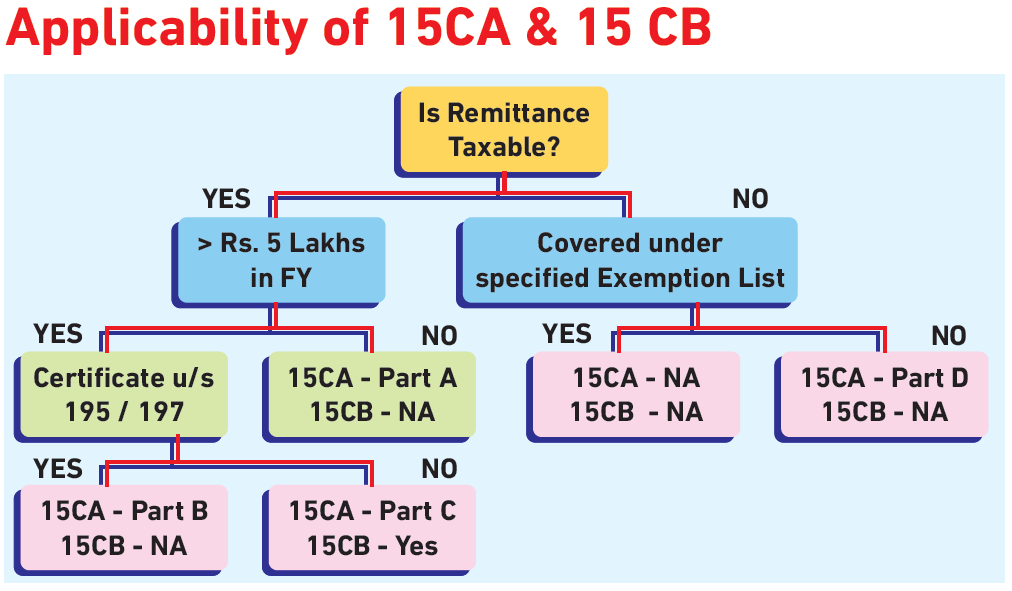

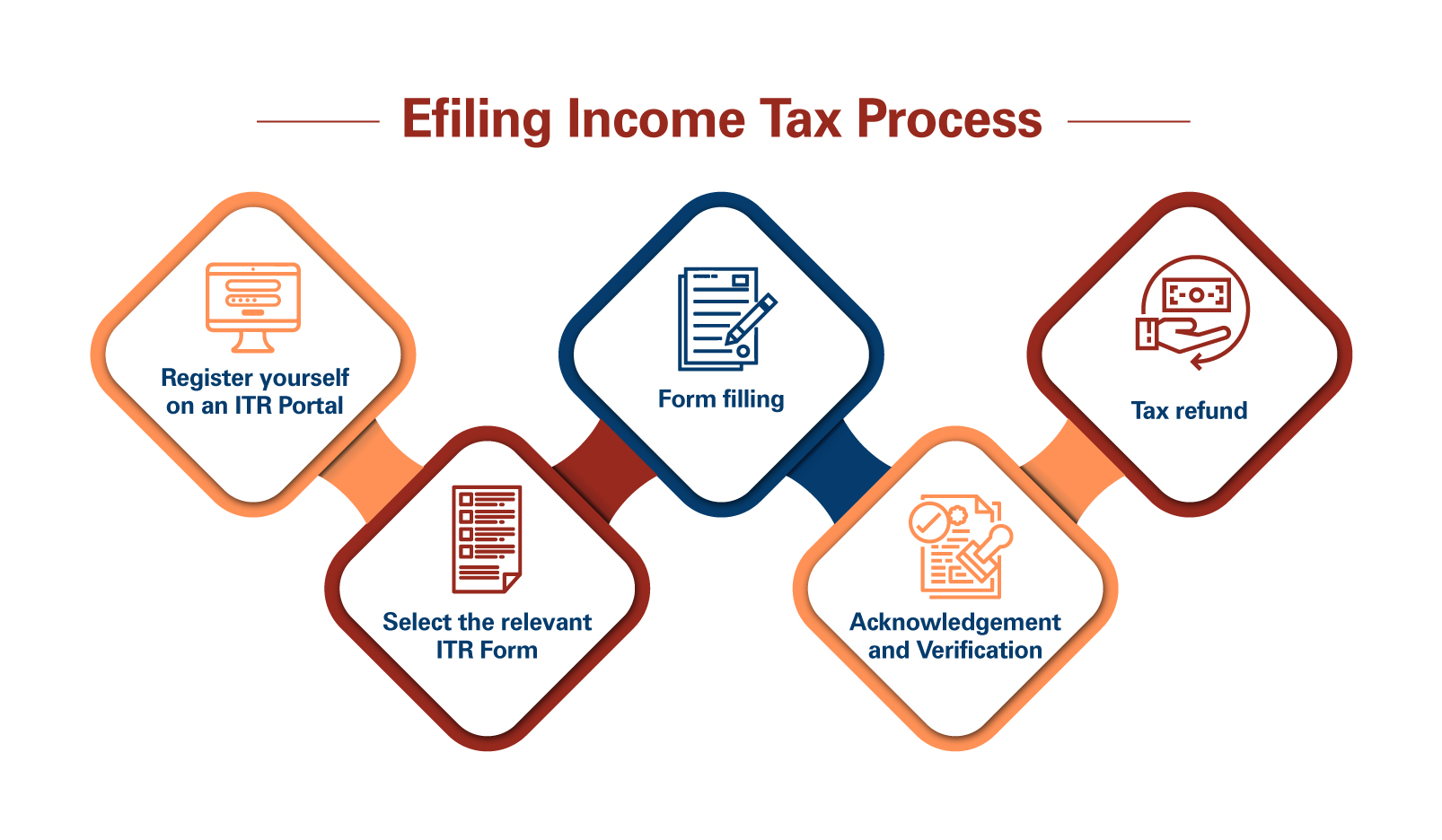

15CA/CB certificate 15CA/CB certificate, The requirements for obtaining the 15CA and 15CB certificates vary based on the nature of the transaction and the guidelines set by the Indian tax authorities. Here are the general requirements for each certificate: Form 15CA Requirements: 1. PAN (Permanent Account Number): The person making the remittance (remitter) must… Read More »