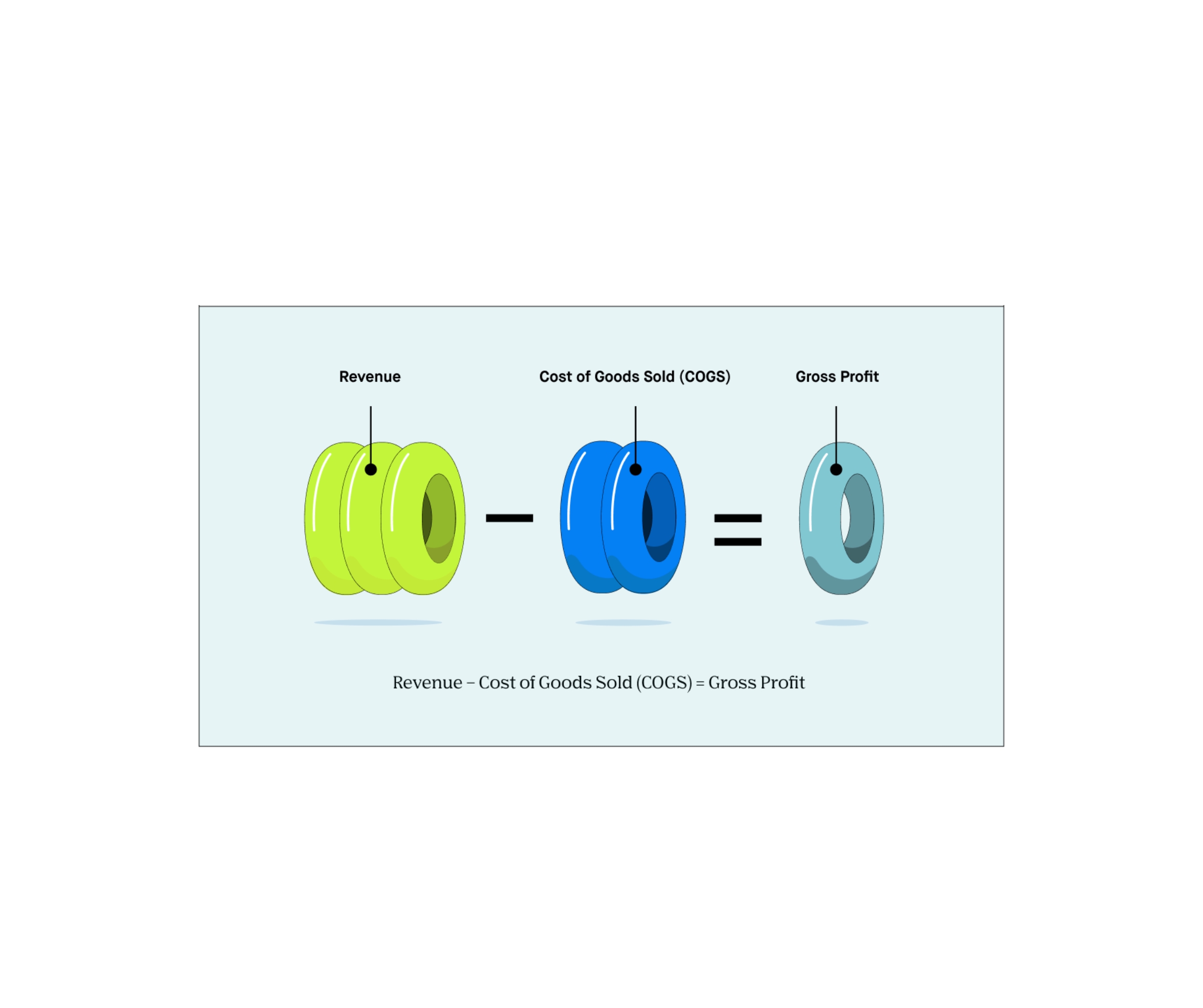

What is the difference between revenue and tax?

Difference between revenue and tax Difference between revenue and tax are so many. Both Revenue and tax are two distinct concepts in the realm of finance and government. Revenue refers to the funds or income generated by individuals, businesses, or governments through various channels, including sales, services, investments, and taxes. It represents the overall amount… Read More »