How to file ITR 2?

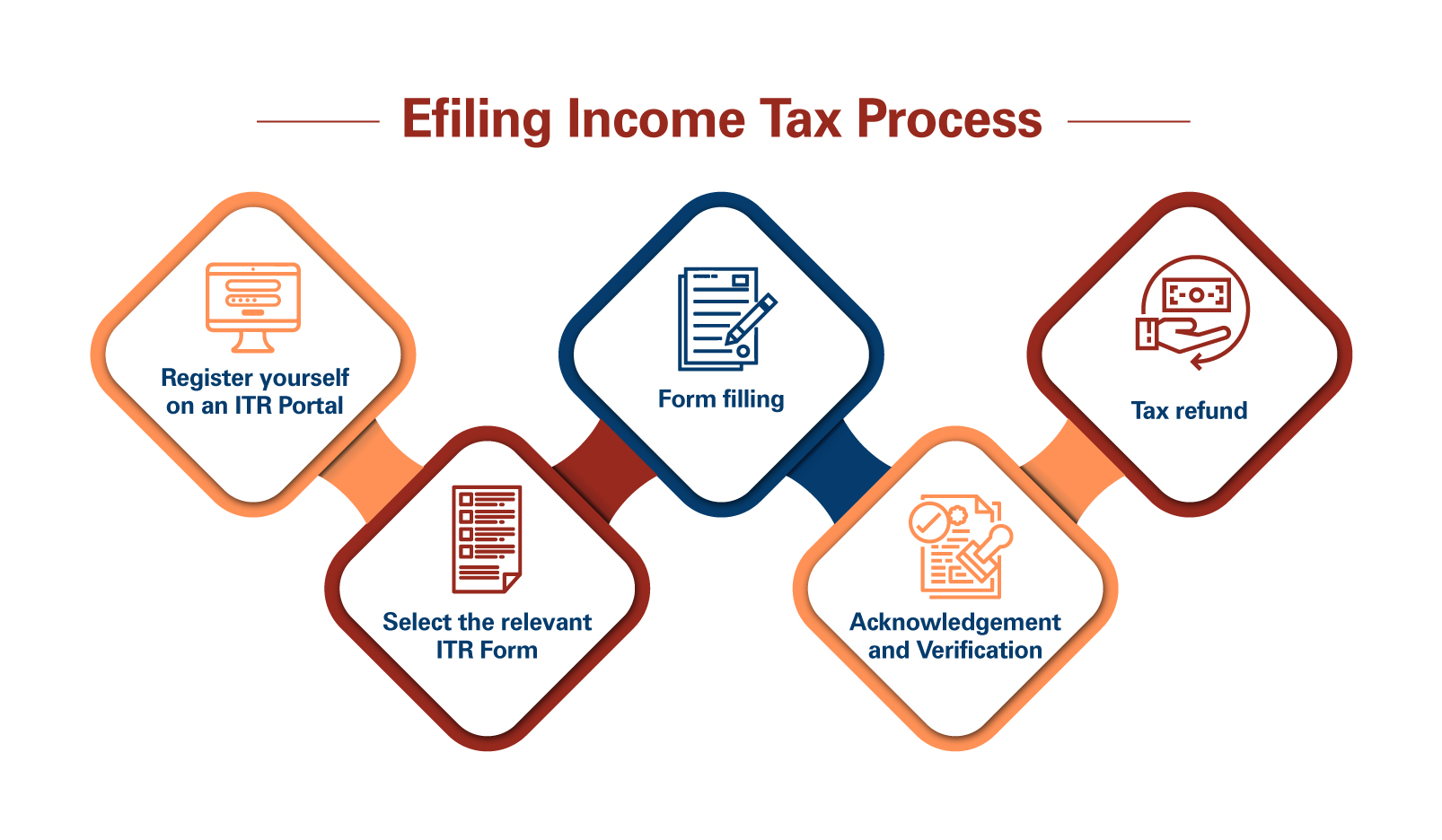

How to file ITR 2 To file your Income Tax Return (ITR) using ITR-2 form, which is applicable to individuals and Hindu Undivided Families (HUFs) having income from various sources except for business or profession, you can follow these steps: 1. Gather your documents: Collect all the necessary documents, including your Form 16 (if applicable),… Read More »