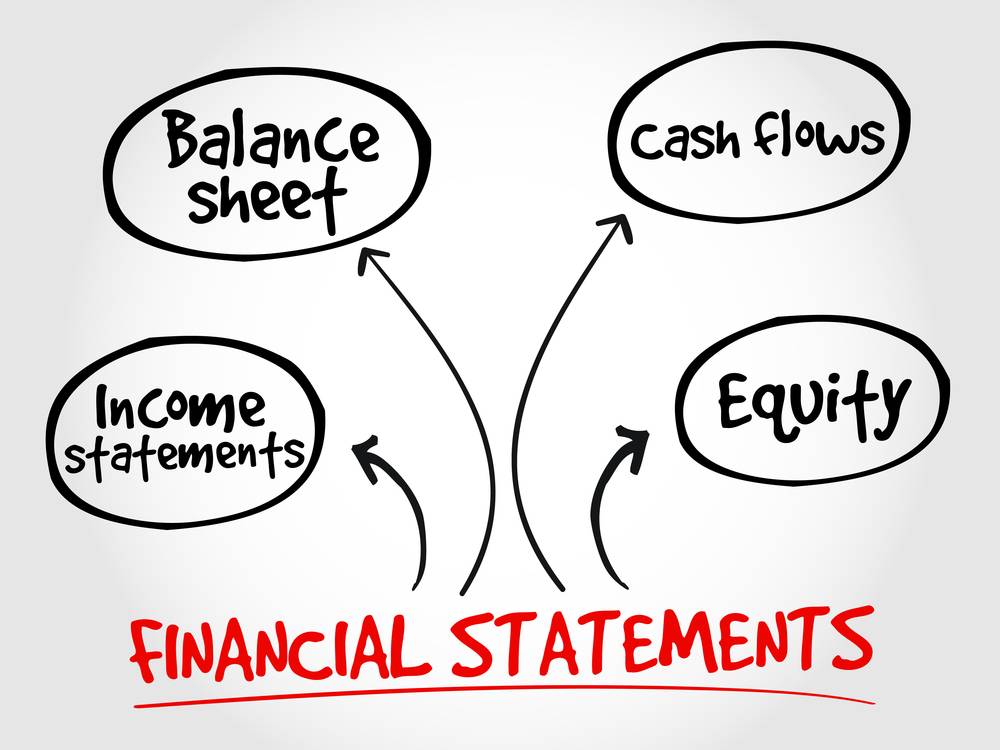

How to prepare financials of a company?

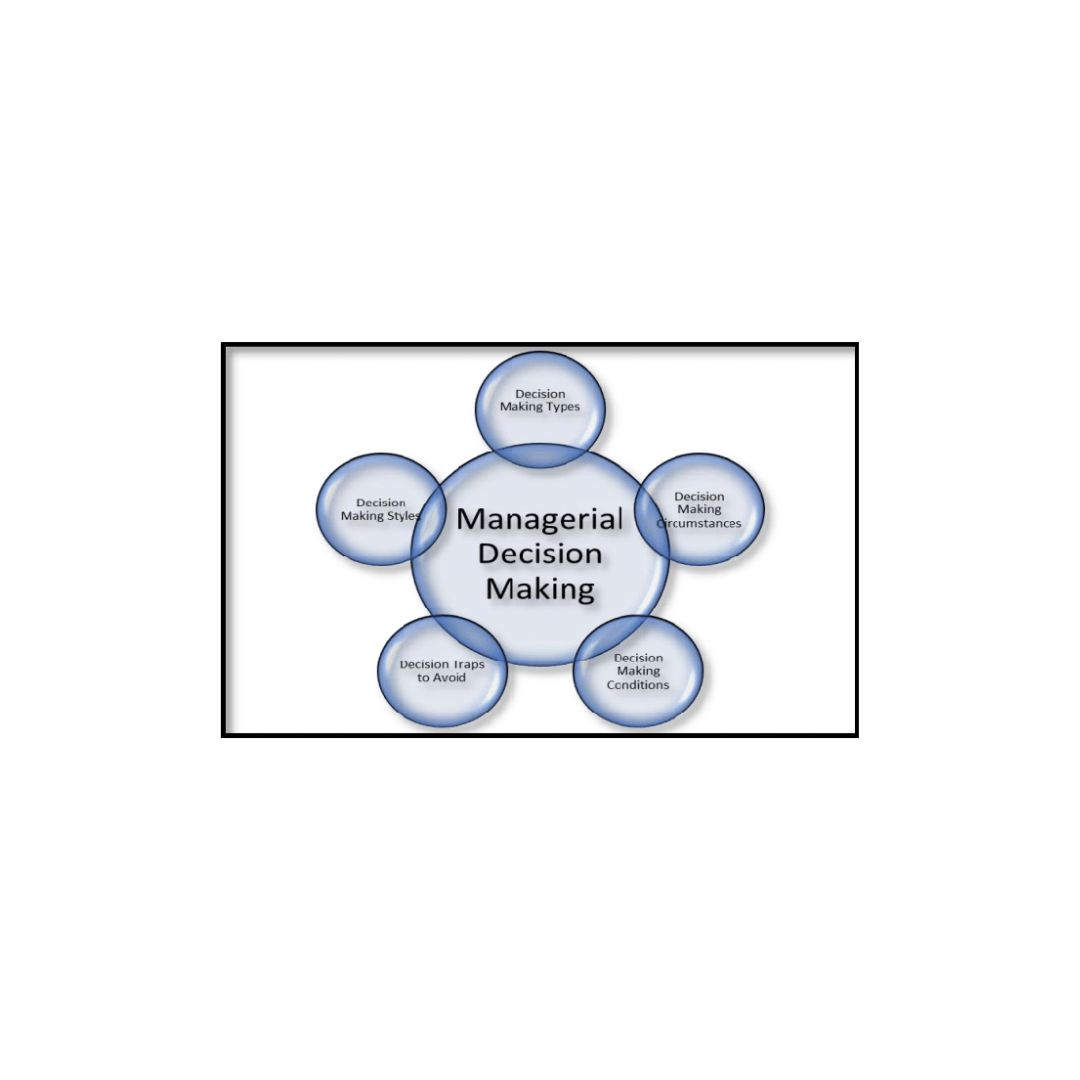

User Intent Business owners, entrepreneurs, accountants, and finance professionals often seek guidance on preparing a company’s financials. This article provides a step-by-step approach to preparing financial statements while ensuring accuracy, compliance, and financial clarity. Introduction Financial statements play a crucial role in showcasing a company’s financial health. They help stakeholders, investors, and regulators understand… Read More »