Tax planning with reference to dividend policy?

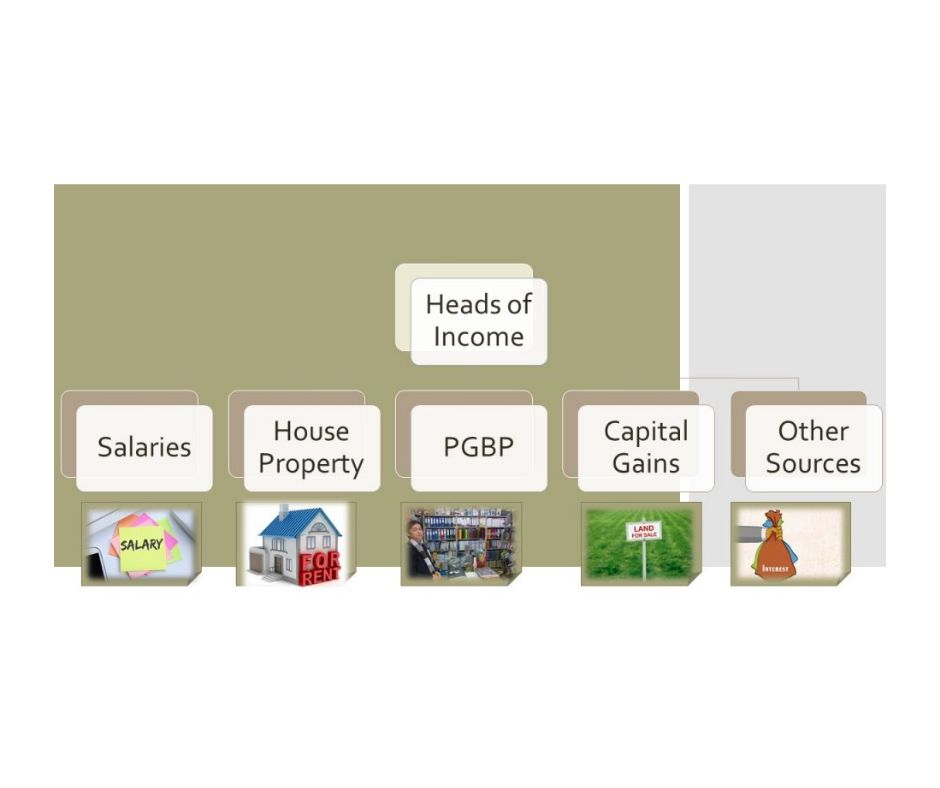

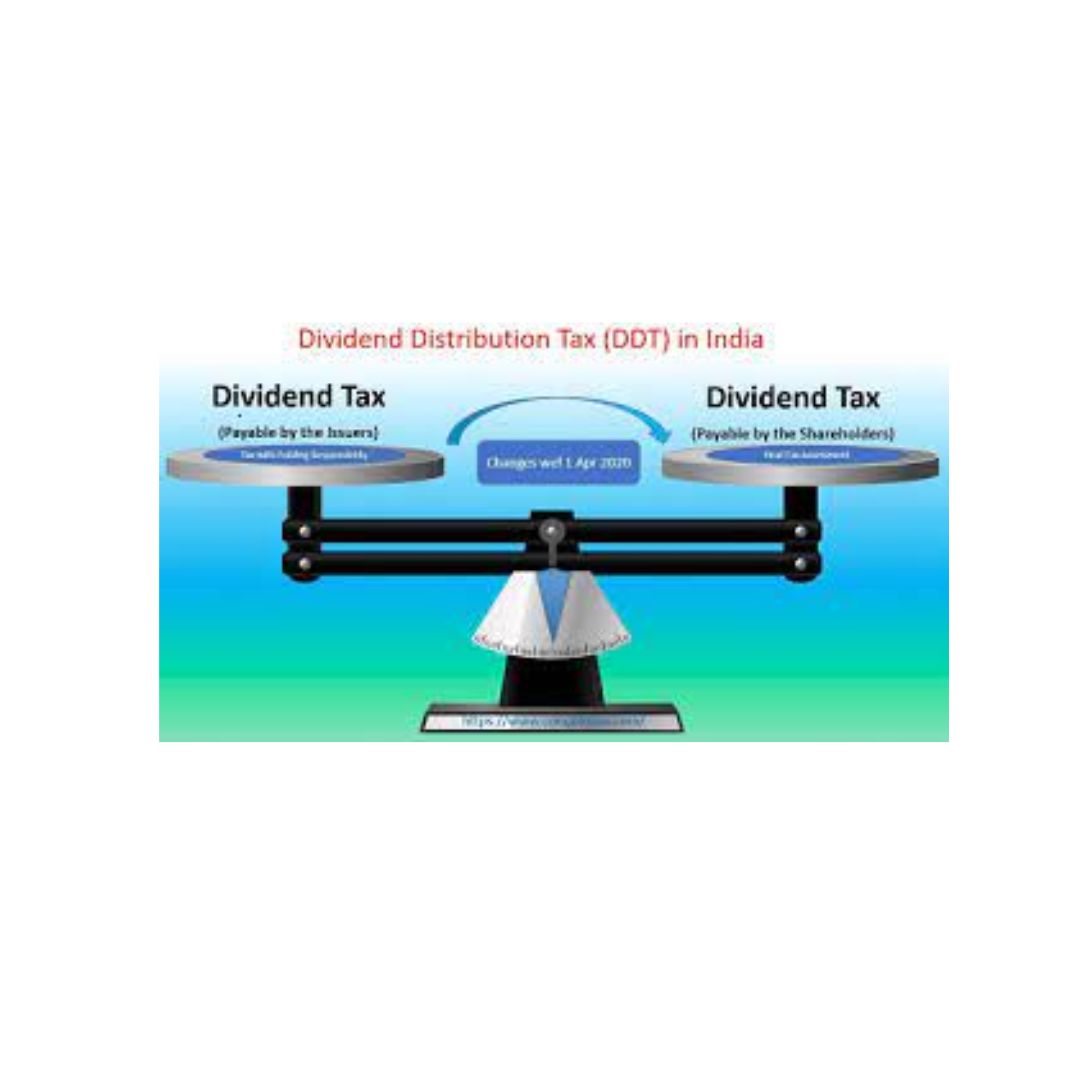

Dividend policy Tax planning with reference to dividend policy involves structuring the payment of dividends in a tax-efficient manner. Here are some key tax planning considerations in relation to dividend policy: Dividend Distribution Tax (DDT): In certain jurisdictions, companies are required to pay DDT on the distribution of dividends. Tax planning can involve assessing the… Read More »