Expat tax laws in India?

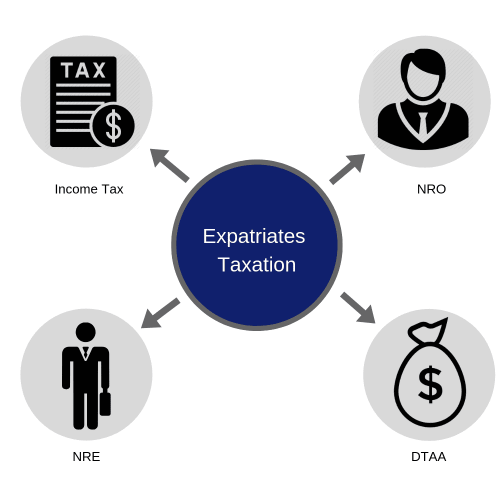

Expat tax laws in India Introduction With the rise of globalization and cross-border employment, India has become a popular destination for expatriates (expats) working in various sectors. While India offers immense opportunities for expats, understanding and complying with its complex tax laws is crucial for avoiding legal issues and optimizing tax liability. Expat tax… Read More »